Selling inherited property in Mexico involves clearing title, working with a notary, and managing capital gains taxes in both Mexico and the U.S. Legal complexities, trust requirements, and inheritance disputes are common. You'll likely need help navigating dual laws.

If you're a U.S. citizen who inherited property in Mexico, the legal process ahead can feel overwhelming.

Between probate, foreign ownership rules, and international tax reporting, many heirs delay or lose money simply because they didn't know where to start.

Here's what you need to know right now:

- You can sell inherited property in Mexico, but ownership must be legally transferred first.

- A notary and appraiser are required by Mexican law before any sale.

- Capital gains taxes and IRS rules apply, even if the money stays in Mexico.

- Citizenship status, property location, and inheritance paperwork all impact what you can do next.

We help the U.S.-based heirs overcome the red tape of selling property in Mexico, especially those who need to fix birth certificates, claim citizenship, or resolve inheritance issues from afar.

Our bilingual legal team ensures you don't get stuck in a legal maze.

Want the full breakdown, including how to handle tax reporting, citizenship conflicts, and selling property held in a fideicomiso? It's all below.

Can You Sell Inherited Property in Mexico?

Yes, you can, but only after the property is legally transferred into your name.

Inheritance alone doesn't give you the legal authority to sell.

Whether your parents left you a will or not, the first step is proving your right to ownership under Mexican law.

If There's No Will: Intate Probate

When no will exists, Mexican law requires intestate probate, a legal process where the court verifies your relationship to the deceased, confirms there are no disputes among family members, and formally names you as an heir.

This process includes:

- Filing an inheritance claim with a local judge or notary.

- Appointing an executor (known as an albacea).

- Proving your familial link through birth certificates and other documents.

- Creating a property inventory and getting an official appraisal.

- Waiting 12-24 months in some cases due to court backlogs.

All Heirs t Agree

If multiple heirs are listed, everyone must agree to sell.

If even one sibling or cousin disagrees, the property cannot legally be sold until the dispute is resolved.

Practical scenario: Many of our clients come to us after months of stalled sales due to family disagreement, or after discovering that an estranged sibling has a legal claim.

We help mediate, clarify legal options, and resolve the impasse with court support if needed.

Mexican Notary Iuired

A certified Mexican notary public (notario público) must oversee the sale.

Their role goes beyond administrative duties. They verify ownership, clear the title, ensure taxes are paid, and record the new deed.

Without a notary, your sale won't be legally recognized.

Pro tip: Notaries in Mexico act like lawyers rather than clerks. Choose one with inheritance and property law experience.

“If the property aren't in my parent's name at death, how do I claim ownership?”

This happens often.

Many families discover too late that the property was never formally titled in the deceased's name.

In these cases, additional steps are required:

- You may need to prove possession or legal use through property tax receipts (predial).

- You may need to file a property regularization or title correction case before inheritance proceedings can begin.

We routinely assist clients in this exact situation, including helping correct birth certificates or resolve name mismatches that block inheritance transfers.

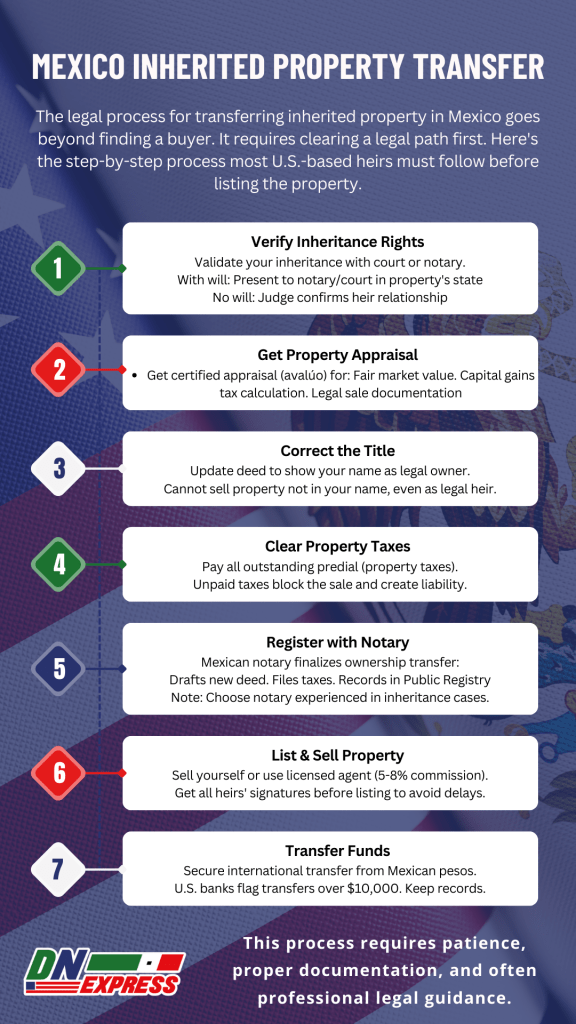

Legal Process Overview (Step-by-Step)

The legal process for transferring inherited property in Mexico goes beyond finding a buyer. It requires clearing a legal path first.

Here's the step-by-step process most U.S.-based heirs must follow before listing the property:

1. Verify Inheritance Rights

Before anything else, you must validate your inheritance through one of two paths:

- If there is a will: Present it to a notary or court in the same Mexican state where the property is located.

- If there is no will: Initiate intestate succession, where a judge confirms your relationship to the deceased and names you as a rightful heir.

You'll need original birth certificates, CURPs (if Mexican), IDs, and death certificates.

If there are mismatched names or spelling errors, those must be corrected before proceeding.

2. Get a Property Appraisal

Mexico requires a certified appraisal (avaluó) to:

- Establish the fair market value of the property

- Calculate capital gains taxes

- Support the legal sale with a valuation document

You'll also need this to prove you're not selling under market value, which could trigger tax audits.

3. Correct the Title

If the deed still shows your parent, grandparent, or an incorrect name, you'll need to legally update the title.

This often becomes a sticking point.

- Title correction may require extra notary steps or court intervention.

- You cannot sell property that's not in your name, even if you're the legal heir.

4. Clear Any Outstanding Property Taxes

You must show proof that all predial (property taxes) are up to date.

If these taxes are unpaid, the sale can be blocked, and you could be liable for fines.

If you're unsure of the tax status, a lawyer can request a certificate of no debt from the local municipality.

5. Register the Transfer with a Notary

Once the inheritance and title are sorted, a Mexican notary finalizes the ownership transfer.

They'll:

- Draft the new deed

- Collect and file taxes

- Record the sale in the Public Registry

Note: Notaries in Mexico are legal officials, not clerical workers. Choose one experienced in inheritance cases.

6. List and Sell the Property

You can sell the property yourself or work with a licensed agent.

Agents charge 5% to 8% commission, but may help you find buyers faster.

Tip: If family is involved, be sure all heirs sign off before listing to avoid delays or legal disputes later.

7. Transfer the Funds Securely

Once sold, your funds will likely be in Mexican pesos.

Avoid bad exchange rates and high bank fees by using a trusted service like Wise for international transfers.

U.S. banks may flag large foreign wire transfers, especially over $10,000. Keep records and consult your tax advisor.

Special Case: Fideicomiso (Bank Trust)

If your property is within 50 km of the coast or 100 km of a border, it may be held in a fideicomiso, a bank trust required for foreign ownership.

Selling a property in a fideicomiso requires:

- Notifying the bank trustee

- Paying a trust cancellation or transfer fee ($1,000-$1,500 USD)

- Amending or terminating the trust before the sale

Failing to do this can block the transaction entirely.

Capital Gains Exemptions

You may be able to reduce or avoid paying capital gains tax in Mexico if you meet certain requirements.

These exemptions are especially relevant if you're selling a property that was once your family home.

You May Qualify If:

- You are a Mexican resident (not merely a citizen) and can prove it.

- The inherited home was your primary residence for at least two years before the sale.

- You haven't claimed this exemption on another property sale within the last three years.

Required documents typically include:

- Proof of address (like utility bills or voter registration)

- A CURP number

- Residency documentation

If you're not a Mexican resident, you may still qualify for partial exemptions, but the process becomes complex, and timing matters.

How can I avoid capital gains tax on inherited foreign property?

- In Mexico: Apply for an exemption through the notary during the sale process.

You'll need to prove residency, ownership, and usage of the property. This must be done before the sale is registered.

- In the U.S.: Inherited property benefits from the stepped-up basis rule.

That means your taxable gain is calculated from the value at the time of death, not when the property was originally purchased. This often reduces or eliminates capital gains on the U.S. side.

Note: Selling under market value to reduce taxes can trigger red flags with both Mexican authorities and the IRS.

Need help applying for these exemptions or proving residency from abroad?

Our legal team walks you through the entire exemption process and helps correct any documentation that might block your eligibility.

Special Considerations for Non-Citizens

If you're a U.S. citizen inheriting property in Mexico, and especially if you've never held Mexican citizenship, there are several unique restrictions and requirements you need to understand before selling.

1. You Can't Directly Own Coastal or Border Property

Under Mexican law, foreigners cannot directly own land within 50 kilometers of the coastline or 100 kilometers of a national border.

If the inherited property is in one of these “restricted zones,” it must be held in a fideicomiso, a bank-managed trust.

Here's how it works:

- The bank legally owns the property but holds it in trust for you.

- You (or your family) are listed as the beneficiary.

- To sell the property, you'll need to coordinate with the trustee bank and pay transfer or cancellation fees, usually $1,000 to $1,500 USD.

Pro Tip: Don't try to skip the fideicomiso process. It's mandatory. Selling without complying can invalidate the transfer or expose you to fines.

2. Lack of Mexican Citizenship Can Limit Your Rights

While you don't technically need Mexican citizenship to inherit or sell property, not having it can complicate your sale:

- You may not qualify for tax exemptions reserved for Mexican residents.

- You'll likely pay a higher capital gains rate.

- Some notaries or banks may require additional legal documentation.

This is why many of our clients secure their Mexican nationality before attempting a sale. It saves time, taxes, and headaches.

“Do I need Mexican citizenship to sell inherited property in a restricted zone?”

Not necessarily, but if the property is in a restricted zone, you must either:

- Already have a fideicomiso in place (and be listed as a beneficiary), or

- Work with a Mexican citizen co-owner, or

- Transfer the fideicomiso rights before you can sell.

If you're not a Mexican citizen, you can't bypass the fideicomiso requirement simply because you inherited the property.

Strategy Insight: Leasing Temporarily

Some property owners lease the home to themselves or family members for as little as 5 pesos/month to maintain legal possession and prevent disputes while working out legal or citizenship issues.

While not a long-term solution, this can prevent third-party claims or squatting.

If you're unsure whether your property qualifies as restricted or how to legally transfer it from abroad, our legal team can help you check zoning records, fideicomiso status, and citizenship eligibility, all without a trip to Mexico.

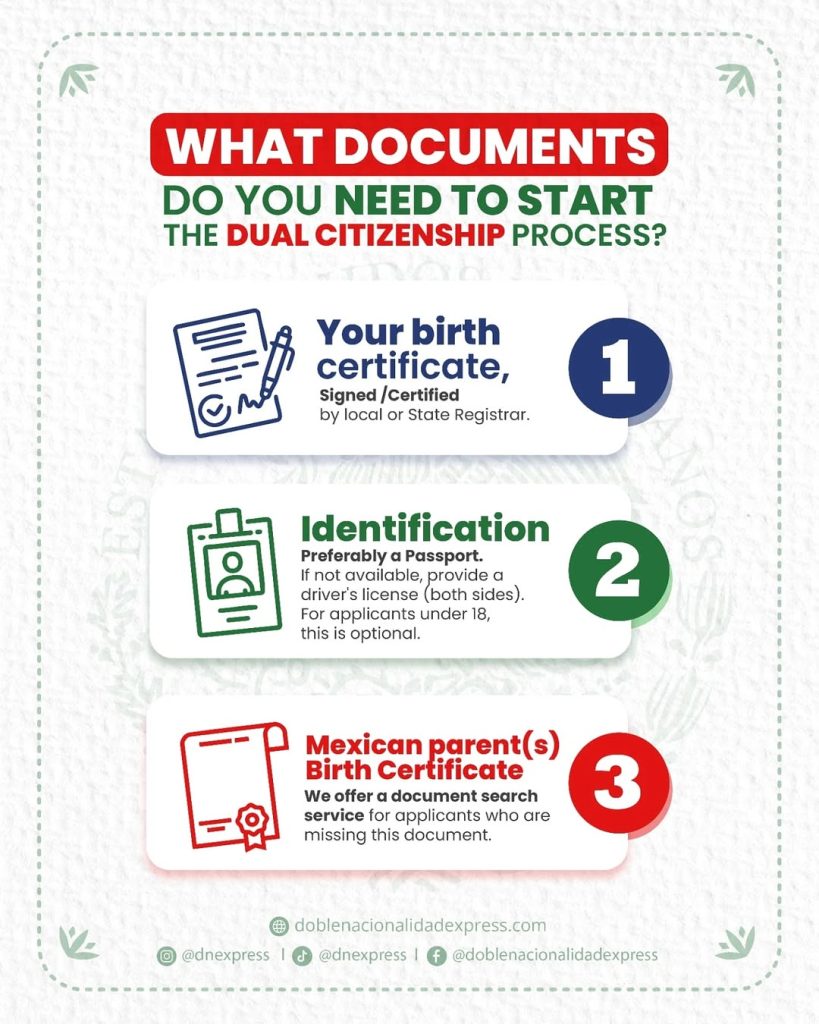

Paperwork You'll Need

Selling inherited property in Mexico goes beyond proving you're an heir.

It requires showing the government, the notary, and the buyer that everything is legally in order.

Missing or incorrect paperwork is one of the top reasons sales are delayed or blocked.

Here's a checklist of the required documents you'll need to gather and review:

Required Documents

- Property Title Deed (escritura pública) Confirms legal ownership and includes key details like size, location, and registration number.

- Inheritance Documentation or Will If there's a will, it must be validated. If not, a legal succession process must name you as heir.

- Certificate of Freedom from Liens (Certificado de Libertad de Gravamen) Proves that the property has no debts, liens, or mortgages.

- Predial Tax Receipts You must show the property taxes are fully paid. These are issued annually by the local municipality.

- Appraisal Report (Avaluó Catastral or Comercial) Required for calculating capital gains and validating the sale price.

- Official IDs and CURPs (for Mexican citizens or those claiming nationality) These must match the inheritance documents exactly, or you risk rejection.

Don't Forget

- Everything must be in Spanish. If your documents are in English (like U.S. birth certificates), they need to be officially translated and apostilled.

- Name mismatches are a huge issue. A typo in your mother's maiden name, a missing accent, or different spelling across documents can block the inheritance. You'll need to correct those first.

This is where Doble Nacionalidad Express steps in.

We help clients review, correct, and file these documents, especially when vital records span two countries with different legal systems.

For detailed information about our services and current pricing, view our service rates.

Risks of DIY Inheritance Sales

It's tempting to save money by managing the sale of inherited property in Mexico on your own, especially if you're already familiar with property law in the U.S.

But Mexico's legal system, tax structure, and property laws are fundamentally different.

Here are the most common risks we see when heirs try to handle everything without legal help:

Hidden Liens or Ownership Disputes

Even if you think the property is debt-free, a lien or unpaid loan might be hiding in the title history.

And if the property was never properly registered in your parent or grandparent's name, you'll face legal delays before you can sell.

Many of our clients had no idea they were facing “unregistered inheritance,” a common problem that goes unnoticed until it's time to transfer ownership.

For comprehensive information about property inheritance in Mexico, the Mexican legal framework provides clear guidance on succession laws and requirements.

Incorrect Tax Filings in Mexico or the U.S.

One of the biggest mistakes heirs make is underreporting or misfiling the sale:

- You must report the sale to the IRS if you're a U.S. resident, even if the funds stay in Mexico.

- If you sell below market value or miss the stepped-up basis rule, you could trigger audits or lose tax benefits.

- In Mexico, mistakes in the appraisal or omission of required deductions can mean paying far higher capital gains than you should.

For large inheritances, you may also need to file Form 3520 to report foreign trust transactions or inheritance receipts to the IRS.

Delays from Uncorrected Documents

Even a simple issue, like your name being spelled differently on your birth certificate and the will, can delay the sale for months.

Add to that the need for apostilles, official translations, and local validation, and it's easy to see why many heirs give up halfway through the process.

Fraudulent Buyers or Corrupt Agents

Unfortunately, not every “agent” in Mexico is licensed or reputable.

Some charge high upfront fees and vanish. Others make offers that look good but are designed to take advantage of foreign sellers unfamiliar with local law.

We've helped multiple clients recover from botched deals where their property was listed or sold without proper authorization.

Currency Exchange Losses

Wire transfers from Mexico to the U.S. can come with:

- High bank fees

- Poor exchange rates

- Reporting flags that delay fund availability

If you don't use a trusted intermediary, you risk losing thousands simply by converting pesos to dollars the wrong way.

That advice stuck with us, and it's why Doble Nacionalidad Express was founded: to protect families who inherit property across borders and help them close these complex sales with peace of mind.

Why Work with Doble Nacionalidad Express

Selling inherited property in Mexico goes beyond crossing legal t's and dotting bureaucratic i's.

It's about reclaiming what's rightfully yours.

We have helped hundreds of U.S.-based families untangle cross-border inheritance issues, even when others told them it was “too late.”

What We Help With

- Correcting Mexican birth certificates and fixing name mismatches that delay inheritance.

- Securing Mexican citizenship remotely, without stepping foot in a consulate or courtroom.

- Preparing all inheritance and sale documents in both Spanish and English with licensed bilingual attorneys.

- Avoiding months of consular backlogs, misfilings, or dead ends.

- Legally clearing the way for you to sell your inherited property, no travel required.

A Client Story

“I thought I couldn't sell the house because I wasn't Mexican. The consulate told me I didn't qualify. But DNExpress reviewed my documents, fixed my birth certificate, got me dual citizenship, and walked me through the whole sale, without me stepping foot in Mexico.”

The Risks of Doing It Alone

- Endless paperwork loops between U.S. and Mexican agencies

- Multiple trips to Mexico to sign or verify documents

- Rejected filings due to mismatched names or missing CURPs

- Thousands lost in overpaid taxes or poorly handled transfers

If you're feeling stuck, confused, or need someone to tell you what's actually possible, we're here to help.

This goes beyond paperwork. It's about protecting your family's legacy.

We'll walk you through your best next steps, without pressure, with clarity.

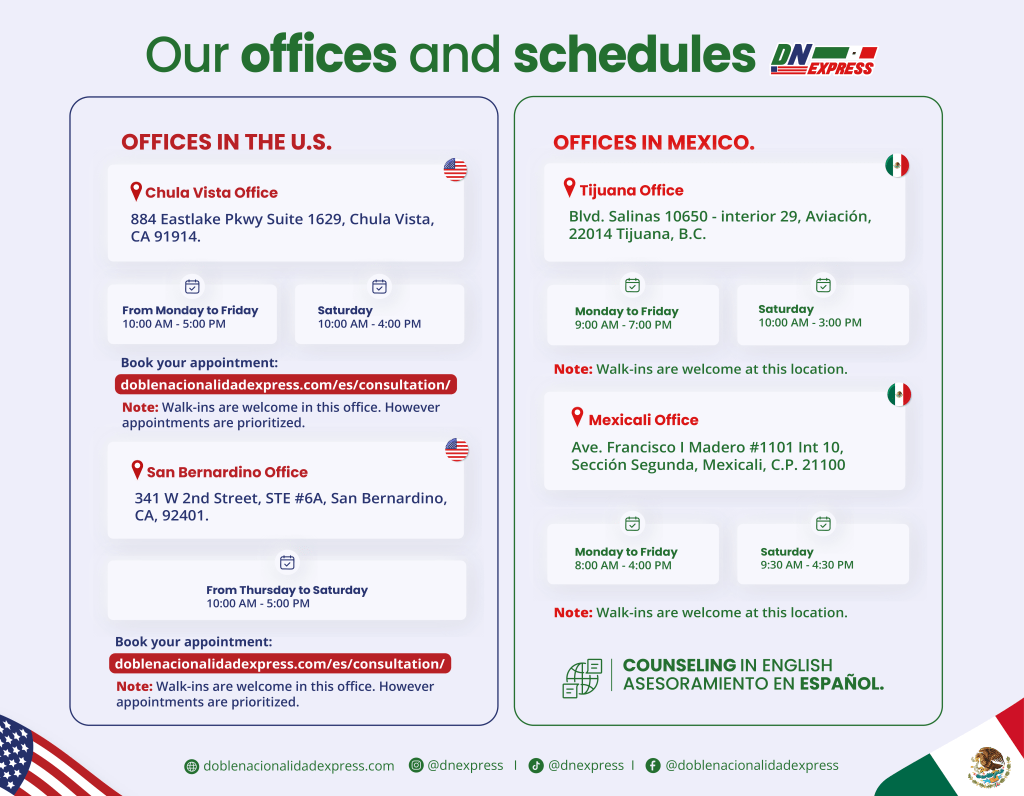

Ready to Sell Your Inherited Property?

Doble Nacionalidad Express Offices and Schedules.

Whether you've inherited land from your parents, a home from your grandparents, or discovered unexpected property in Mexico, Doble Nacionalidad Express is here to help you turn that inheritance into opportunity.

We help you:

- Fix paperwork issues that delay or block inheritance

- Secure your Mexican citizenship if needed for the sale

- Navigate the complex tax rules in both the U.S. and Mexico

- Finalize the entire sale without ever stepping foot in Mexico

- No consulate hassles. No family drama. Clear answers and legal progress.

📲 Schedule a Free Case Review or Message Us on WhatsApp Today

For immediate assistance with consulate appointments, we can also help secure your Mexican consulate appointment while processing your citizenship or property documents.

You've already inherited the property. Now let's make sure you can truly claim it.

FAQ

Do I need a lawyer to sell property in Mexico?

Yes, especially one experienced in cross-border inheritance and property law.

A bilingual attorney can help prevent costly mistakes in both countries.

How do I transfer ownership of an inherited property?

You must go through:

- Probate (to establish legal heirship),

- Notary registration, and

- Title update with the Public Registry.

What is the 183-day rule in Mexico?

If you reside in Mexico for over 183 days in a calendar year, you may be considered a tax resident, potentially triggering different tax obligations.

How much is inheritance tax in Mexico?

Mexico does not charge a federal inheritance tax, but:

- Capital gains tax applies upon sale.

- Local taxes and notary fees vary by state.

What is the maximum you can inherit without paying taxes?

There's no fixed exemption limit.

Your tax liability depends on:

- Whether you qualify for exemptions,

- The appraised value of the property,

- Your citizenship or residency status, and

- Proper use of the stepped-up basis for U.S. tax purposes.