Dual U.S.-Mexico citizens only pay taxes in both countries if they meet each country's tax residency rules.

The U.S. taxes citizens worldwide, but the U.S.–Mexico tax treaty and foreign tax credits usually prevent double-paying. Mexico taxes you if you live there for over 183 days or earn income locally.

That means whether you owe in one or both countries depends on where you actually live, work, and bank, not your passport. In this article, we'll break down how the rules apply to:

- U.S.-born children of Mexican parents or grandparents

- Adults reclaiming citizenship after a prior rejection

- Families applying for everyone at once

- Heritage-based applicants living abroad

- People seeking practical benefits like property rights or healthcare

As the founder of Doble Nacionalidad Express, I've seen countless families misunderstand these rules. They either overpay, underpay, or risk penalties.

Our team helps clients reclaim their Mexican citizenship and set up the right tax strategy from day one. You can keep your money and your peace of mind.

If you want the full breakdown, including how to avoid double taxation, what treaty provisions really mean, and the most frequent mistakes dual citizens make, keep reading.

How It Differs by Citizenship Situation

While the tax rules for U.S.–Mexico dual citizens share the same foundation, your personal situation can shape how these rules apply.

The U.S. always requires you to file, and Mexico taxes based on residency. For detailed information about Mexican citizenship eligibility, understanding your specific situation is key.

U.S.-Born Children of Mexican Parents or Grandparents

If you were born in the U.S. but gained Mexican citizenship through your parents or grandparents, you are not automatically considered a Mexican tax resident. For those wondering about Mexico tax obligations specifically, citizenship alone doesn't trigger tax requirements.

Until you move to Mexico and meet residency tests (183 days or “center of vital interests”), you'll generally only file U.S. taxes.

Adults Reclaiming Citizenship After Consulate Rejection or Misinformation

Many adults were wrongly told they didn't qualify for Mexican nationality, only to discover later they do. Understanding your situation if you were born in US to Mexican parents is the first step.

Once recognized as citizens, their tax situation is the same as any other dual citizen. Mexican taxes only apply once residency rules are met.

Families Securing Citizenship for All Members

When an entire family becomes dual citizens and relocates to Mexico, they often trigger Mexican tax residency together.

Coordinated tax planning can help manage joint filing, foreign tax credits, and income allocation to minimize or avoid double taxation.

Heritage & Cultural Identity Applicants

Some claim Mexican citizenship purely for cultural pride or family legacy while continuing to live abroad. If you're exploring citizenship through grandparents, the process may require additional steps.

In these cases, the Mexican tax authority (SAT) won't require filings unless you spend significant time in Mexico or have Mexican-source income.

Practical Benefits Seekers (Travel, Property, Healthcare)

Owning property or accessing healthcare in Mexico does not by itself make you a Mexican tax resident.

However, income from renting that property is taxable in Mexico and reportable to the IRS. This means you'll need to plan for filings in both countries.

The Basics of U.S. & Mexican Tax Systems for Dual Citizens

Grasping the core tax rules of each country is key for avoiding costly mistakes as a dual U.S.–Mexico citizen.

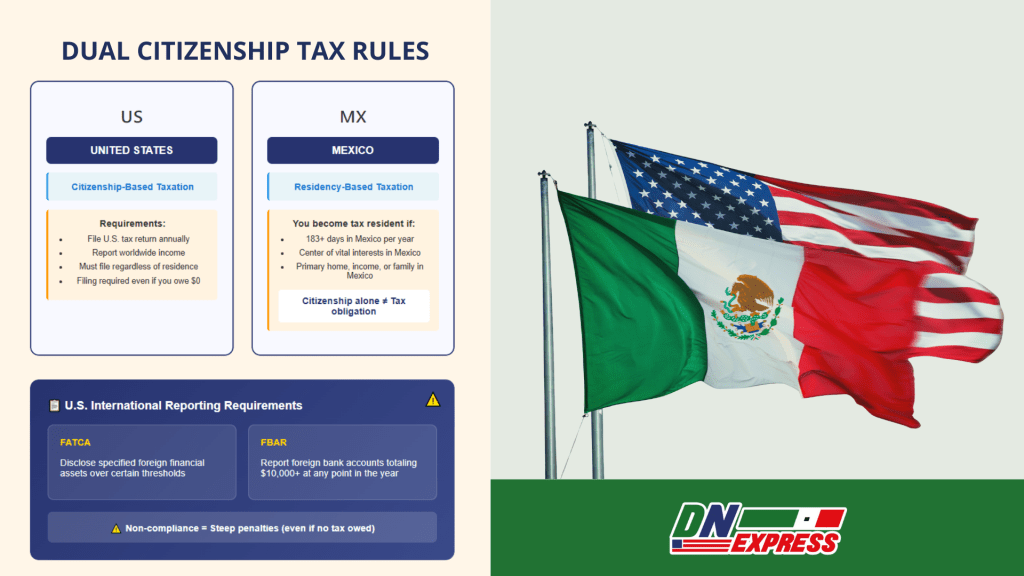

U.S. Taxes on Worldwide Income

The United States is one of the only countries that taxes based on citizenship, not residency.

This means you must file a U.S. tax return every year no matter where you live, reporting your worldwide income. Even if you owe nothing due to credits or exclusions, the filing requirement remains.

Mexico Taxes Based on Residency, Not Citizenship

Mexico's tax system is residency-based. You become a Mexican tax resident if you:

- Spend 183 days or more in Mexico in a calendar year (following the substantial presence test concept), or

- Have your “center of vital interests” in Mexico (primary home, main income source, or family).

Citizenship alone does not trigger Mexican taxes. Residency does.

FATCA & FBAR Requirements for Foreign Accounts

U.S. citizens, including dual citizens, must comply with international reporting rules:

- FATCA: Disclose specified foreign financial assets over certain thresholds.

- FBAR: Report foreign bank accounts totaling $10,000 USD or more at any point in the year.

Noncompliance can result in steep penalties, even if no tax is owed.

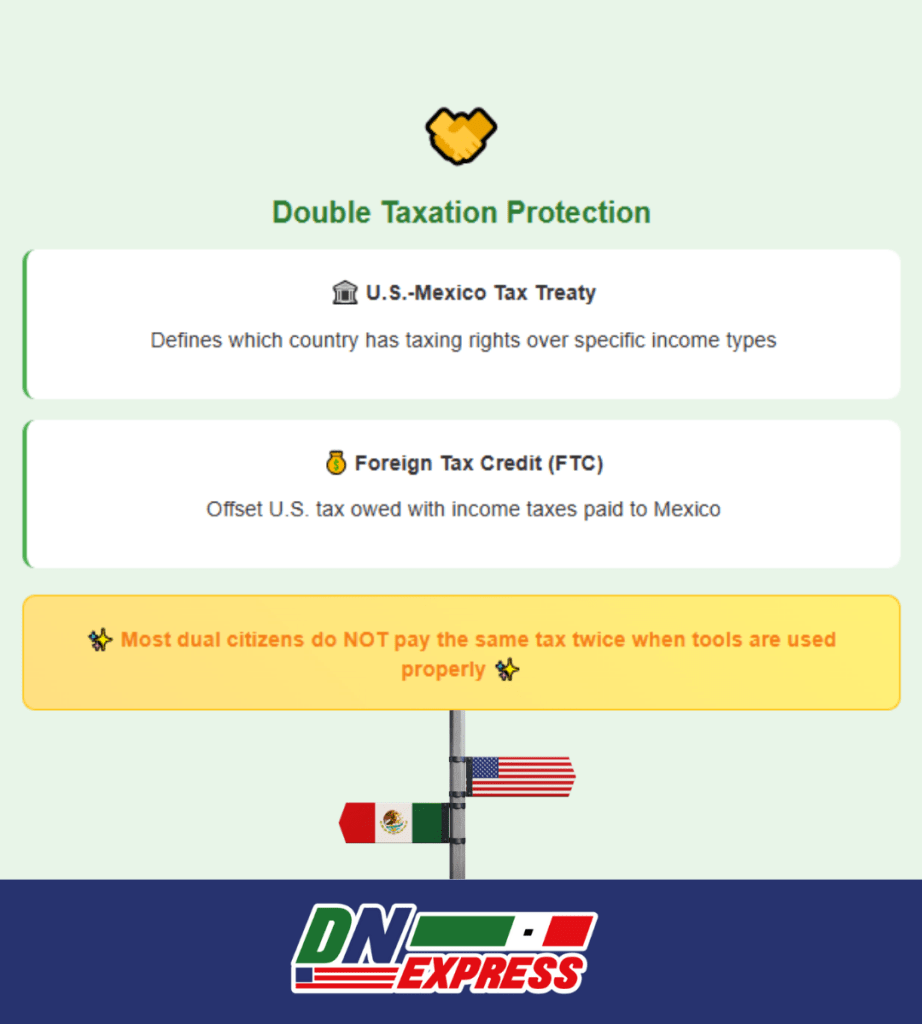

U.S.–Mexico Tax Treaty & Foreign Tax Credit System

The U.S.–Mexico tax treaty helps prevent double taxation by defining which country has taxing rights over certain income types.

The Foreign Tax Credit (FTC) allows you to offset U.S. tax owed with income taxes paid to Mexico. When used properly, these tools mean most dual citizens do not actually pay the same tax twice.

Frequent Worries People Have

Accidentally Becoming a Mexican Tax Resident by Staying Too Long

Many dual citizens fear crossing the 183-day threshold without realizing it. This can trigger Mexican tax residency.

In some cases, the “center of vital interests” rule can apply even earlier if your main home, family, or income is in Mexico. The solution is to track your days and know the residency criteria before making long visits.

Conflicting Advice from Accountants About Where to Pay

Cross-border taxation is complex. Not all accountants specialize in U.S.–Mexico tax law.

This often leads to conflicting instructions on which country gets primary taxing rights. The truth is, the tax treaty outlines the rules. You need a professional who can interpret and apply them to your unique situation based on current U.S. international tax policy.

U.S. Reporting Rules (FBAR, FATCA) Causing Stress

Even if you owe no U.S. tax, you may still have to report foreign bank accounts and other financial assets.

The FBAR applies if the combined value of your non-U.S. accounts exceeds $10,000 at any time in the year. FATCA requires reporting certain foreign assets above set thresholds.

Missing these filings can lead to serious penalties.

Penalties for Late Filings in Either Country

Both the IRS and Mexico's SAT can impose steep fines for late or missing returns. This happens even when no tax is due.

For U.S. citizens abroad, an automatic extension to June 15 is available. However, you still need to plan ahead and gather the right documents for both countries on time.

DNExpress Tax & Citizenship Guidance

Why Tax Rules Matter Before, During, and After Applying for Mexican Citizenship

Securing your Mexican citizenship is only part of the journey. Knowing how your tax obligations will change is equally vital.

A well-timed application can help you avoid becoming a Mexican tax resident prematurely, preserve your U.S. compliance, and plan for cross-border filings in advance. Understanding the true citizenship application costs upfront helps you budget effectively.

How DNExpress Ensures Legal, Secure, and Consulate-Free Processing

Our process is designed for U.S.-based clients who want to avoid the long waits, bureaucracy, and travel costs of consulate visits.

We handle your entire nationality case remotely, from gathering your civil registry documents to submitting your application.

All while protecting your personal information with strict security protocols through our comprehensive dual nationality services.

Licensed Attorneys with Cross-Border Expertise

DNExpress is staffed with licensed, binational attorneys who grasp both Mexican nationality law and U.S.–Mexico tax implications.

This means we can help you anticipate the financial impact of citizenship, not simply win your case on paper.

Client Stories: People Who Got Citizenship Without Creating New Tax Headaches

One family came to us after being told by a local accountant they'd face double taxation the moment they became Mexican citizens.

We reviewed their residency plans, applied for citizenship for the parents and children. We ensured their move to Mexico happened after the optimal tax year cutoff, avoiding thousands in unnecessary taxes.

Downsides of Doing It Yourself

Missed Residency/Treaty Nuances Causing Unexpected Taxes

Without knowing the fine print of the U.S.–Mexico tax treaty or Mexican tax residency rules, costly mistakes are easy to make. Like triggering tax residency in both countries in the same year.

Filing Errors Leading to Penalties

Incorrect forms, missed reporting obligations (like FBAR or FATCA), or misapplied tax credits can lead to steep fines. This happens even when no tax is actually owed.

Delays from Incomplete Applications

Mexican nationality cases are often delayed because applicants submit incomplete or incorrect civil registry documents.

Each correction can add months to the process.

Stress from Navigating Two Bureaucracies

The IRS and Mexico's SAT both have complex rules, deadlines, and forms.

Managing both at the same time while also handling a citizenship application can quickly become overwhelming.

Next Steps

If you're ready to secure your Mexican citizenship and stay fully compliant with U.S. and Mexican tax laws, here's how we can help you start today:

- Schedule a Free Case Review: We'll confirm your eligibility, explain the process, and answer your initial questions with no obligation.

- Get a Citizenship + Tax Strategy Call: Our licensed, binational attorneys will help you map out the best timeline for your nationality application and tax planning.

- Message Us on WhatsApp: Quick questions? Send us a message anytime and we'll respond promptly.

Your Mexican citizenship is beyond a legal status. It's a connection to your heritage, your rights, and your opportunities on both sides of the border.

With DNExpress, you'll gain it without unnecessary tax surprises or bureaucratic delays.

Frequently Asked Questions

What are the benefits of dual citizenship in Mexico and the U.S.?

Dual citizenship offers a blend of freedom, security, and opportunity: visa-free travel between both countries, full property ownership rights in Mexico, access to Mexican healthcare, the ability to vote in both nations, and greater business and investment flexibility.

Do you pay taxes in both countries if you are a dual citizen?

You'll only pay taxes in both if you meet each country's tax residency criteria in the same year.

The U.S. always requires a tax return, but actual tax owed depends on whether credits or exclusions apply. Mexico only taxes you if you meet its residency rules. For additional guidance, review common questions about dual citizenship scenarios.

Is there double taxation between the U.S. and Mexico?

True double taxation is rare. The U.S.–Mexico tax treaty and the Foreign Tax Credit usually prevent paying twice on the same income, based on international frameworks like the OECD Model Tax Convention.

However, you must still file returns in both countries when required, even if no tax is ultimately due.

How to avoid double taxation as a dual citizen?

- Use the Foreign Tax Credit to offset U.S. tax with Mexican taxes paid.

- Claim the Foreign Earned Income Exclusion (FEIE) if eligible.

- Plan your residency days to avoid dual residency in the same year.

- Leverage treaty provisions for specific income types (like pensions or rentals).

Do U.S. citizens abroad get taxed twice?

Generally no. U.S. citizens living abroad can use credits and exclusions to reduce or eliminate U.S. tax on income already taxed by their country of residence.

The key is timely filing and correct use of forms like Form 1116 (FTC) and Form 2555 (FEIE).

How do taxes work if you live in two countries?

You may have split-year residency, where part of the year you are taxed as a resident in one country and part in another.

Both countries may require returns, but the treaty determines where income is taxed and prevents paying twice.

Which two countries tax based on citizenship?

Only the United States and Eritrea impose taxes on citizens regardless of where they live.

Why do I have to pay U.S. taxes if I live abroad?

Because U.S. tax law is citizenship-based. Even if you live permanently in Mexico, the U.S. still requires annual tax reporting and payment (if applicable).

The good news: credits and exclusions typically mean you won't pay twice.