Thinking of Mexican dual citizenship?

While it offers cultural and legal benefits, it also comes with surprising cons: dual taxes, civic duties, and complex paperwork.

For U.S.-born Mexicans, parents, and spouses, these challenges can differ, and professional help can prevent costly mistakes.

Mexican nationality laws can feel overwhelming, especially if you’ve been rejected by a consulate or face missing documents.

We help you recognize the risks upfront as key to avoiding delays, denials, or even unintentional tax liabilities. We’ve helped thousands secure dual citizenship, without consulate visits or endless bureaucracy.

Our licensed attorneys handle everything so you can focus on your family and future.

Want to know if it’s worth it for you? Below, we’ll break down the disadvantages, how they vary by situation, and how to protect yourself from frequent pitfalls.

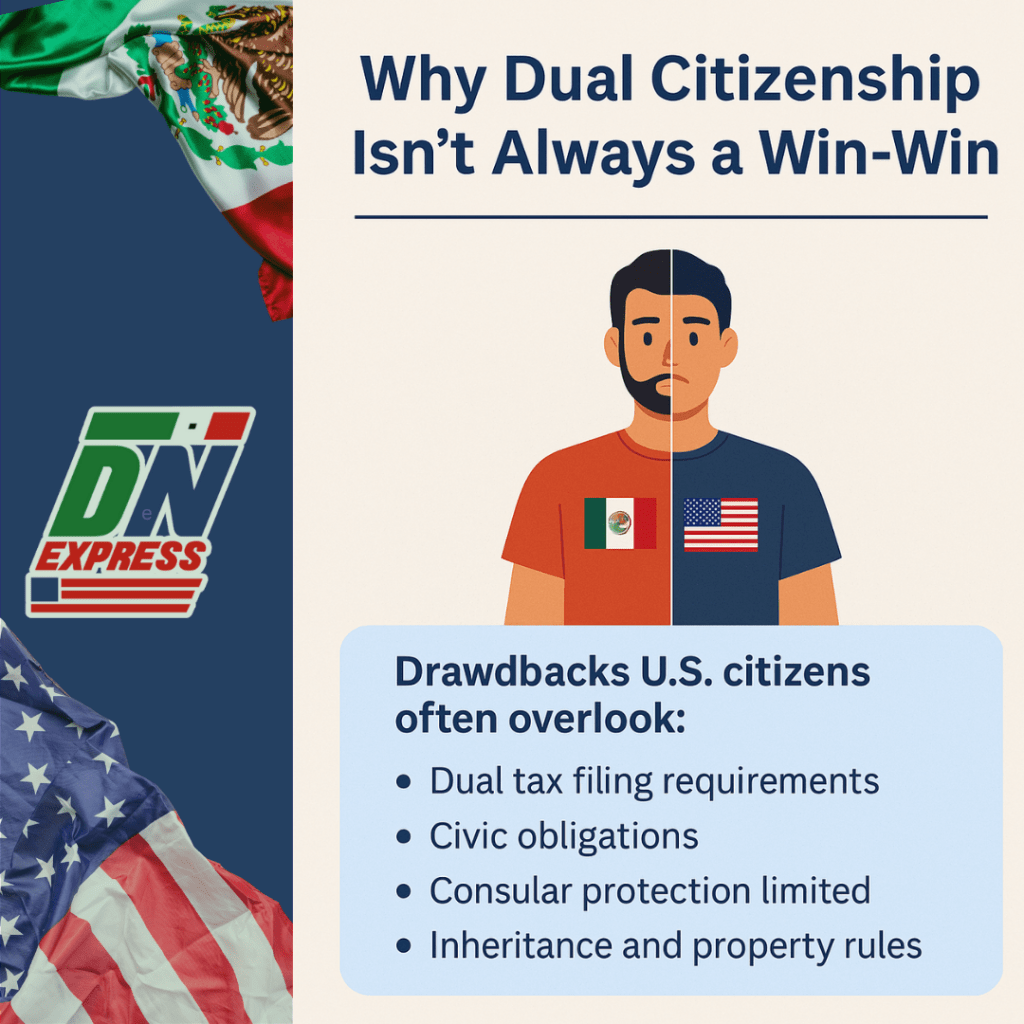

Why Dual Citizenship Isn’t Always a Win-Win

Mexican dual citizenship promises freedom of movement, property rights, and a deeper connection to your heritage.

But for U.S.-born Mexicans, parents registering children, or spouses of citizens, the reality is more complex. Behind the perks, there are legal, financial, and emotional factors that deserve a closer look.

One overlooked challenge? Cultural identity conflict.

Many clients tell us they’ve struggled with the question: “Do I feel fully Mexican or American?”

Dual nationality brings pride, but it can also stir conflicting emotions, especially when policies or expectations from both countries don’t align.

You might be wondering: “Is it worth getting dual citizenship in Mexico?” The answer depends on your situation.

For some, the benefits far outweigh the drawbacks. For others, issues like taxes, civic obligations, and inheritance laws can create unexpected complications.

Let’s break down these disadvantages step by step so you can make an informed decision.

The Top Disadvantages of Mexican Dual Citizenship

While holding two passports offers undeniable perks, Mexican dual citizenship isn’t without its challenges.

From tax complications to civic obligations, we recommend weighing these potential downsides before you apply.

Tax Implications You Can’t Ignore

One of the biggest concerns for U.S. citizens seeking Mexican nationality is taxes.

Even if you don’t live in Mexico, you’re still legally obligated to file U.S. tax returns on worldwide income. Adding Mexican citizenship can layer on additional reporting requirements.

Under Mexico's tax laws, if you stay in the country 183 days or more in a calendar year, you're considered a tax resident. This means filing Mexican tax returns and paying Mexican taxes on your Mexican-source income.

While the U.S.–Mexico tax treaty helps prevent double taxation, the paperwork is complex and penalties for mistakes are steep.

Plus, U.S. citizens with foreign bank accounts in Mexico must comply with FATCA reporting, making the process even more burdensome. FBAR reporting requirements.

Answer:

Do I have to pay taxes to Mexico if I have dual citizenship?

Not automatically. We clarify that you become a Mexican tax resident only if you live in Mexico for over 183 days.

But you still have to track and report foreign assets to the U.S. IRS.

Military and Civic Obligations

Male dual citizens are legally required to register for Mexico’s Servicio Militar Nacional at age 18. In reality, this “military service” is symbolic, a one-day registration event in most cases, but failure to register can block certain rights, like obtaining a Mexican passport or voting.

Other civic duties, like jury service or civil participation, exist in Mexican law.

While rarely enforced for dual citizens living abroad, they’re worth noting for those planning extended stays.

Worry:

What if I’m called for military service?

You won’t be forced into active duty. Registration is typically administrative, but skipping it can limit access to government services in Mexico.

Loss of U.S. Consular Protection in Mexico

Dual nationals face a unique vulnerability: on Mexican soil, they’re considered Mexican citizens first.

This means U.S. embassies and consulates often cannot intervene if you’re arrested, detained, or facing legal issues in Mexico.

Answer:

Does dual citizenship affect U.S. citizenship?

No. You don’t lose your U.S. citizenship by obtaining Mexican nationality. But in Mexico, U.S. consular protection is limited because you’re seen as a Mexican national under local laws.

Bureaucracy and Legal Complexities

Holding two citizenships means managing two sets of bureaucracies.

This includes keeping both passports valid, renewing Mexico’s voter ID (INE), and updating addresses with two governments.

Estate planning also grows complicated. Mexico’s community property laws can conflict with U.S. inheritance plans, especially for dual citizens owning property in Mexico.

Cross-border legal advice is often necessary, which adds to costs.

Other Potential Cons

Some U.S. citizens with dual nationality face barriers to working in sensitive federal jobs or security-clearance positions due to dual loyalty concerns.

And as we noted earlier, cultural conflicts can arise. Many dual citizens wrestle with the emotional tug-of-war: “Am I fully American, fully Mexican, or somewhere in between?”

Question:

What are the negatives of dual citizenship?

In summary:

- Tax and reporting complexity.

- Civic obligations like military registration.

- Limited U.S. protection in Mexico.

- Estate planning challenges.

- Potential job restrictions in certain U.S. government roles.

How These Disadvantages Differ by Situation

While the cons of Mexican dual citizenship are similar in principle, the way they impact you depends heavily on your situation.

Whether you’re reclaiming your heritage, registering a child, or fixing documentation issues, each path has its own set of challenges.

- U.S.-Born Adults with Mexican Parents or Grandparents

Many U.S.-born adults don’t realize they’re already Mexican by law if their parents or even grandparents were born in Mexico.

We help clients recognize that applying often means formalizing a right they already hold.

Still, this group faces tax reporting obligations on both sides of the border and civic duties like military registration for male applicants. They may also encounter emotional complexities around identity:

“Will claiming my Mexican citizenship change how I’m seen in either country?”

- Parents Registering U.S.-Born Children

For parents, the process is about securing rights and future opportunities for their children. But concerns often surface about the long-term implications:

- Will my son have to register for Mexico’s military service at 18?

- Could my child face double tax burdens as an adult?

These are valid worries, though most obligations only activate if the child lives in Mexico for extended periods.

- Mexican Citizens with Foreign-Born Spouses/Dependents

For foreign-born spouses or dependents, citizenship may not always be the best option. Some prefer Mexican permanent residency, which avoids civic obligations like military registration and simplifies tax residency issues.

However, citizenship offers stronger rights: voting, property ownership anywhere in Mexico (even near coasts and borders), and the ability to pass nationality to future children.

Balancing these pros and cons is key before applying.

- Those Rejected by the Mexican Consulate

Consulate rejections often happen because of missing documents, parent unavailability (deceased, estranged, or incarcerated), or perceived inconsistencies in paperwork.

Trying again alone is risky, applications can be denied again for the same reasons, leading to frustration and wasted time.

In these cases, working with licensed attorneys who know how to navigate Mexico’s Registro Civil and federal systems can make the difference between “no” and “approved.”

Name mismatches, unregistered births, or lost Mexican birth certificates (“actas”) are among the most frequent obstacles. Without corrections, dual citizenship applications are often rejected outright.

This group requires patience and legal know-how. For example, fixing a misspelled parent’s name across multiple documents may involve court filings in Mexico, not a process to DIY.

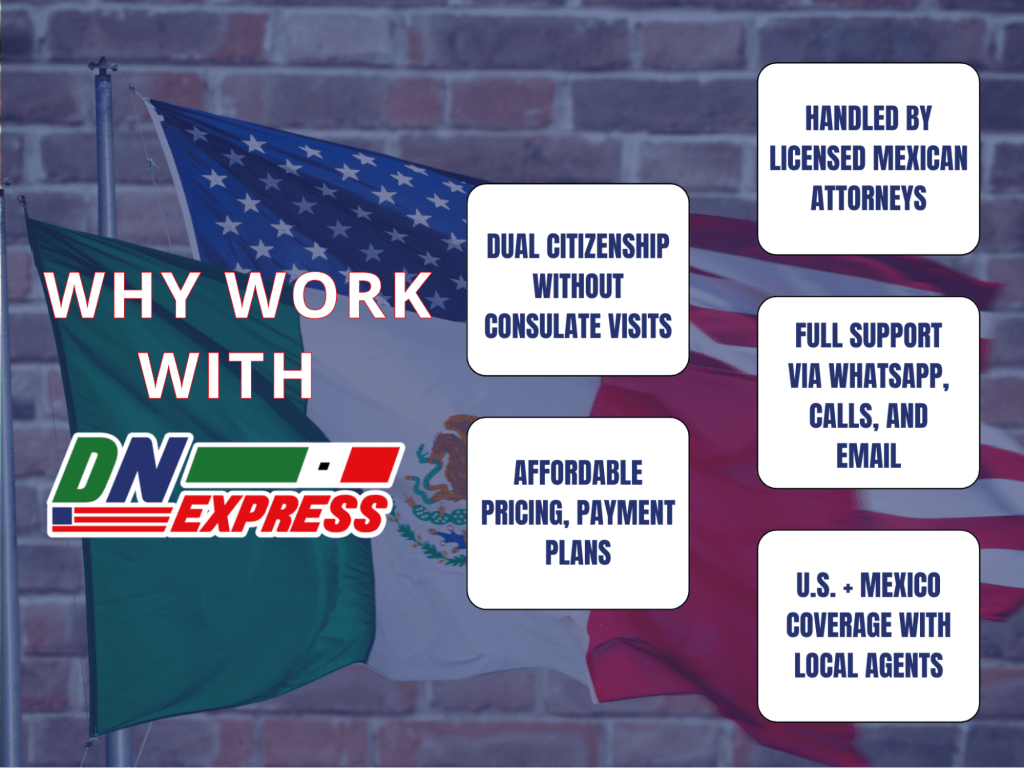

Why Work With Doble Nacionalidad Express (and Skip DIY Pitfalls)

We know that applying for Mexican dual citizenship extends beyond filling out forms. For many, it’s about recovering a birthright, fixing government mistakes, or overcoming consulate rejections.

That’s where Doble Nacionalidad Express makes the difference.

Avoid Costly Mistakes

We specialize in fixing the cases others won’t touch, whether you were rejected at a consulate or your application stalled due to missing documents.

Unlike traditional services, we offer a consulate-free process, making us the ideal choice for clients whose parents are deceased, unavailable, or unable to help.

Our team includes licensed Mexican attorneys and a large, bilingual support staff, not only document processors. This means your case gets full legal attention from start to finish, ensuring every detail aligns with Mexican law.

Benefits of DNExpress

Choosing us means:

- A secure, streamlined process completed from the U.S. or abroad, no need to travel to Mexico or visit a consulate.

- Affordable, transparent pricing with no hidden fees or surprise charges.

- Access to full legal support for complex issues like tax residency and property inheritance concerns.

We’ve helped thousands of clients successfully navigate Mexico’s bureaucracy, even when they thought their cases were hopeless.

Risks of Doing It Yourself

DIY applications often seem cheaper but can come with high hidden costs:

- Endless consulate wait times and canceled appointments.

- Rejected applications due to minor paperwork errors or missing records.

- Emotional stress, especially for families with unavailable parents or grandparents.

The truth is, Mexican nationality laws are complex. Trying to go it alone often leads to delays, frustration, and starting over.

Is Mexican Dual Citizenship Worth It Despite the Cons?

For most U.S.-born Mexicans and their families, the answer is yes, but only if they understand the responsibilities that come with it. Dual nationality opens doors to cultural heritage, property rights, and legal recognition on both sides of the border.

Answer:

Can US citizens get Mexican citizenship?

Absolutely. U.S. citizens are allowed to hold Mexican nationality without renouncing their U.S. citizenship. However, it’s crucial to plan for potential downsides like taxes, civic obligations, and bureaucratic hurdles.

By working with experienced legal professionals, you can ensure the process is smooth and avoid costly mistakes that delay your application.

How to Apply Safely

Don’t let paperwork errors or consulate roadblocks stand in your way. We make Mexican citizenship possible, even for cases others turn down.

Schedule a Free Case Review today or Message Us on WhatsApp to see if you qualify.

Your heritage deserves recognition. Let us help you claim it, quickly, legally, and without unnecessary stress.

FAQ About Dual Citizenship Disadvantages

Before committing to Mexican dual citizenship, it’s natural to wonder how it might impact your finances, legal standing, or day-to-day life. Here are answers to the most frequent concerns.

Is there a con to dual citizenship?

Yes, there are several. Dual nationals are bound by the laws of both countries, meaning they may face:

- Tax obligations in Mexico if they live there more than 183 days.

- Civic duties like registering for Mexico’s Servicio Militar Nacional.

- Limited U.S. consular protection while on Mexican soil.

- Additional paperwork for cross-border banking, estate planning, and property ownership.

While these challenges are manageable for many, they’re important to consider before applying.

Does dual citizenship affect social security benefits?

No. Mexican citizenship does not affect your eligibility for U.S. Social Security benefits. You can still collect payments as a U.S. citizen abroad.

However, the Mexican system operates differently. Mexico’s social security (IMSS) covers citizens and residents, but enrollment is required, and benefits depend on your work history in Mexico.

Dual nationals living in Mexico long-term should review their options under both systems to avoid gaps in coverage.

How much does it cost for dual citizenship in Mexico?

The government fee for processing Mexican nationality applications is approximately $400 USD equivalent.

But many applicants encounter hidden costs when navigating the process alone:

- Fees for apostilles, translations, and certified copies.

- Travel expenses to consulates or Mexico for document recovery.

- Time lost to rejected or delayed applications due to paperwork errors.

Attorney-supported services, like those offered by Doble Nacionalidad Express, can simplify the process with transparent pricing and avoid these surprise expenses.

What is an issue with dual citizenship?

The biggest issues include:

- Navigating dual tax systems and complex reporting requirements.

- Civic obligations like military registration for males.

- Potential conflicts with inheritance laws in Mexico’s community property system.

- Limited U.S. diplomatic protection in Mexico during legal disputes.

For most people, these are inconveniences rather than deal-breakers. But understanding them upfront ensures you’re not caught off guard.