Yes, buying property in Mexico can be a smart investment, especially in tourist zones, retirement hotspots, and emerging markets.

But the payoff depends on your citizenship status, legal setup, and financial goals.

If you're Mexican-American or have family roots in Mexico, your strategy might look very different from someone investing purely for ROI. From avoiding costly fideicomisos to securing legal protection for your kids, property ownership in Mexico comes with unique perks, if you're doing it right.

Doble Nacionalidad Express helps U.S.-based clients secure dual citizenship so they can buy property with fewer restrictions, pass it on to their children legally, and skip the long waits at the consulate.

Want to know if now is the right time to buy? If you need a fideicomiso? How to protect your property from scams?

We break it all down for you below.

Is Buying Property in Mexico a Good Investment? Let's Break It Down

The Upside: Why People Are Investing Now

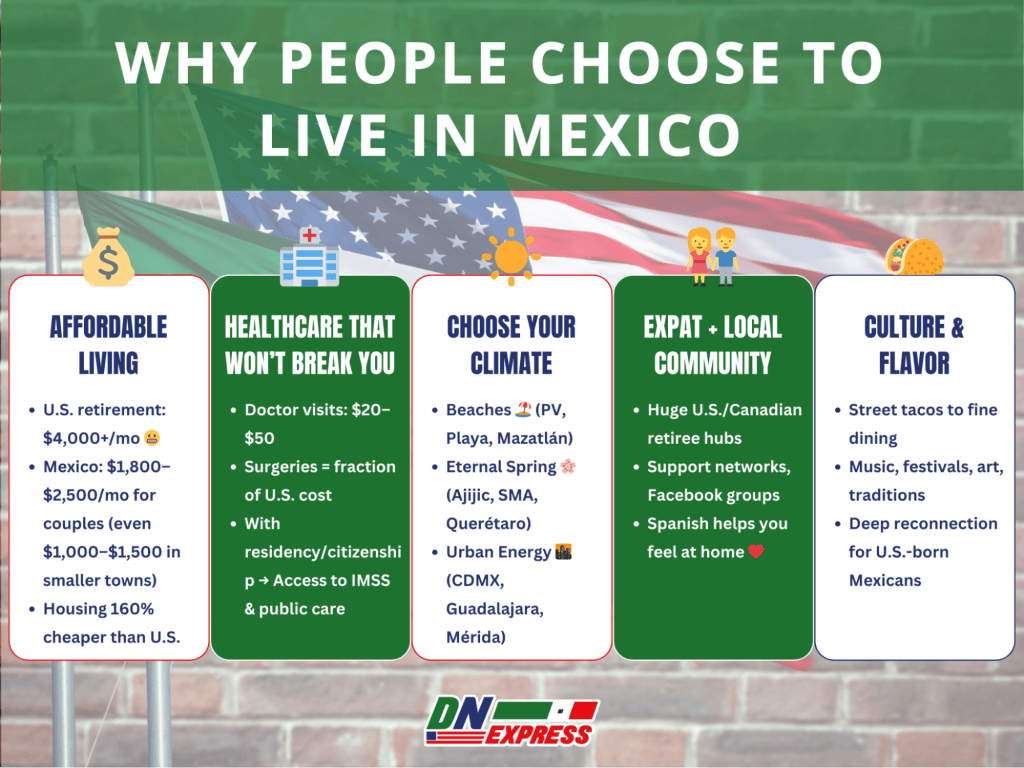

There's a reason Mexico keeps popping up on global property investor radars, especially for Americans looking to stretch their dollar, diversify assets, or retire comfortably.

Here's why:

- Affordable Entry: Compared to U.S. and Canadian markets, Mexico offers much for much less. Whether you're eyeing a beach condo, colonial home, or city apartment, you'll find properties at a fraction of the price you'd pay stateside, even in prime locations.

- Rental ROI: If you're buying with the intent to rent, Mexico's vacation hotspots deliver. Places like Tulum, Playa del Carmen, and Puerto Vallarta boast strong short-term rental demand with average annual returns in the 8-10% range, especially during high tourist seasons.

- Tourism Demand: Mexico consistently ranks among the world's top 10 travel destinations. That constant influx of tourists keeps demand high for short-term rentals, boutique hotels, and even commercial properties in high-traffic zones.

- Growing Expat Zones: Cities like San Miguel de Allende, Lake Chapala, and Mérida have thriving expat communities, excellent amenities, and strong resale potential. They're safe, walkable, and welcoming, especially for retirees and remote workers.

- Retirement Paradise: From low living costs to affordable healthcare, warm weather, and direct flights to the U.S., Mexico checks all the boxes for American retirees looking for quality of life without financial stress.

Is It the Right Time to Buy in 2025?

All signs point to yes, but timing and strategy still matter.

- Home Prices Are Climbing: In cities like Tijuana, property values have surged by over 12.8% year-over-year. The trend is similar across other high-growth regions, driven by both foreign and domestic demand.

- Favorable Exchange Rate: The peso remains weak compared to the U.S. dollar, giving American buyers significant purchasing power in 2025, especially for all-cash deals.

- Post-COVID Migration: Mexico saw a boom in remote workers, retirees, and investors relocating from the U.S. after the pandemic. That trend hasn't slowed. Digital nomads and families are still looking to Mexico as a “Plan B”, and that keeps rental demand strong.

What Are the Risks of Buying Property in Mexico?

Like any international investment, buying property in Mexico comes with risks, especially if you don't know what to watch out for.

Here's what you need to consider:

Legal Complexities

If you're not a Mexican citizen, you can't directly own property in Mexico's “restricted zone”, which includes land within 50 km of the coast or 100 km of international borders.

Instead, you're required to purchase through a bank trust (fideicomiso) or a Mexican corporation.

But here's the catch: dual citizens don't need a fideicomiso. If you have Mexican roots, getting your citizenship first not only simplifies the process, it can save you thousands in setup and annual bank fees.

Want to know how to avoid the fideicomiso entirely? Doble Nacionalidad Express helps U.S.-born children of Mexican nationals secure citizenship, often 100% remotely.

Title Fraud & Scams

Mexico doesn't have a national MLS system.

That means it's easy to overpay, buy from unverified sellers, or unknowingly purchase property with liens or unresolved ownership claims.

Always hire a notario público (Mexican notary lawyer), verify the property title through the Registro Público, and never sign contracts without proper legal guidance. Scams happen most frequently in unregulated or high-demand tourist areas.

Financing Limitations

If you're not a Mexican citizen or resident, getting a mortgage is tough.

Foreigners typically need a large down payment, face higher interest rates, or are denied loans entirely.

Most buyers use:

- Cash

- U.S.-based home equity lines

- Cross-border mortgage brokers (rare and expensive)

If you plan to finance, budget accordingly and be aware of peso-to-dollar fluctuations.

Property Upkeep

Dreaming of a beachfront villa? Don't forget the tropical climate comes with extra wear and tear:

- Humidity leads to mold and rust

- Saltwater corrodes metal and appliances

- Monthly maintenance is needed, even if you're not living there full time

For absentee owners, it's vital to hire trustworthy property managers, many of whom are affordable but must be vetted.

Infrastructure or Safety Gaps

Not every “paradise” is turn-key.

Some up-and-coming areas lack stable:

- Roads

- Electricity

- Water services

- Internet

And yes, safety can vary. While tourist zones are generally secure, some rural or border areas may have cartel presence or inconsistent law enforcement.

Always research the region, and talk to locals or property professionals you trust.

Do Americans Pay Property Taxes in Mexico?

Yes, if you own property in Mexico, you'll pay predial, which is the equivalent of U.S. property tax.

But here's the good news: it's shockingly low by U.S. standards.

Most property owners pay between $100-$500 USD per year, depending on the location, size, and value of the property. In many areas, you'll even get a discount for paying the full year in advance during the first few months.

Other Costs to Expect:

In addition to annual taxes, buyers should also budget for:

Notary Fees: Required by law for any property transfer. Expect around 1-2% of the property value.

Bank Trust (Fideicomiso) Setup: If you're not a citizen, you'll pay $500-$1,000 USD annually in bank fees.

Closing Costs: Typically run 4-7% of the purchase price, including government fees, registration, legal review, and trust fees.

If you're a dual citizen, you can avoid the fideicomiso and some of those bank fees altogether. Another big incentive to reclaim your Mexican nationality if you're eligible.

Unique Use Cases: Beyond ROI, Actual People, Actual Goals

Not everyone buys property in Mexico for profit.

For many of our clients at Doble Nacionalidad Express, property is a path to security, legacy, and freedom, especially when dual citizenship opens doors others can't access.

Here's what that looks like in life:

Parents: Building Now, For the Next Generation

Many Mexican-American families are buying land or homes in Mexico now, not for immediate returns, but to protect future inheritance.

When your kids are dual citizens:

- They can legally inherit property in restricted zones

- You avoid fideicomiso renewals or trust complications

- Your family legacy stays rooted in Mexico, without legal risk

For families that lost land in Mexico due to documentation issues, this is often a way to reclaim what was once theirs.

Digital Nomads: Working Remotely, Living Legally

Mexico is one of the top destinations for remote workers, especially in cities like Mexico City, Oaxaca, and Mérida.

But many don't know they can use property ownership to qualify for temporary or permanent residency.

Pair that with dual citizenship and:

- You can buy directly, without a fideicomiso

- Avoid visa renewals or rental headaches

- Rent out the property when traveling elsewhere

It's a flexible lifestyle, made legal and profitable with the right documents.

Retirees: Escaping Inflation, Securing Care

Healthcare costs in the U.S. are skyrocketing.

For retirees, buying a home in Mexico means:

- Access to high-quality private care for a fraction of U.S. prices

- Warm weather and walkable towns

- A fixed income that stretches much farther

Many clients use their Mexican citizenship to access IMSS (public healthcare) or to avoid foreign ownership restrictions as they settle into retirement.

Young Chicanos: Starting Early, Building Equity

It's not only retirees and digital nomads making moves.

We're seeing plenty of first- and second-generation Mexican-Americans buying property in their 20s and 30s, especially in emerging markets like Guanajuato or Bacalar.

They're using:

- Dual citizenship to bypass legal blocks

- Property purchases to start building wealth while the market's still affordable

- Their cultural ties to invest in something meaningful beyond an Airbnb listing

For many, it's about property investment, it's about reconnecting to a place their family never stopped calling home.

What Happens If You Do It Yourself?

Buying property in Mexico differs from buying in the U.S., and trying to navigate it alone can cost you time, money, and peace of mind.

Here's what we see happen most often when people go the DIY route:

Misfiled Paperwork = Denied Permits or Invalid Title

One small error on your property deed, CURP, or birth certificate, even a spelling mistake, can lead to serious legal consequences.

We've seen clients:

- Lose months waiting on corrections from municipal offices

- Be denied building permits or utilities

- Have their property ownership delayed or disputed due to title inconsistencies

Language Barriers and Legal Loopholes

Property contracts in Mexico are written in Spanish legal terms, and not all agents fully explain them.

Without a bilingual legal team:

- You might sign agreements with hidden clauses

- You could miss critical deadlines for registration or trust renewals

- You may not even realize the property you're buying has unpaid debts or ownership disputes

Delays Due to Missing CURP or Birth Certificate Mismatches

If your name appears differently on your U.S. and Mexican documents, or if you're missing a CURP (Mexico's personal ID number), your property transaction can grind to a halt.

We help correct those issues before they cause problems.

Risk of Scams from Shady Developers or Unverified Agents

We've had clients come to us after losing thousands in deposits to fake listings or developers who never finished construction.

The absence of a national MLS and regulation leaves room for fraud, especially in tourist zones.

Bottom line? This process requires careful navigation, especially when property laws, inheritance rules, and trust structures differ so dramatically from what most Americans are used to.

When you're dealing with cross-border legal systems, land ownership, and family legacies, having the right professionals on your side is necessary.

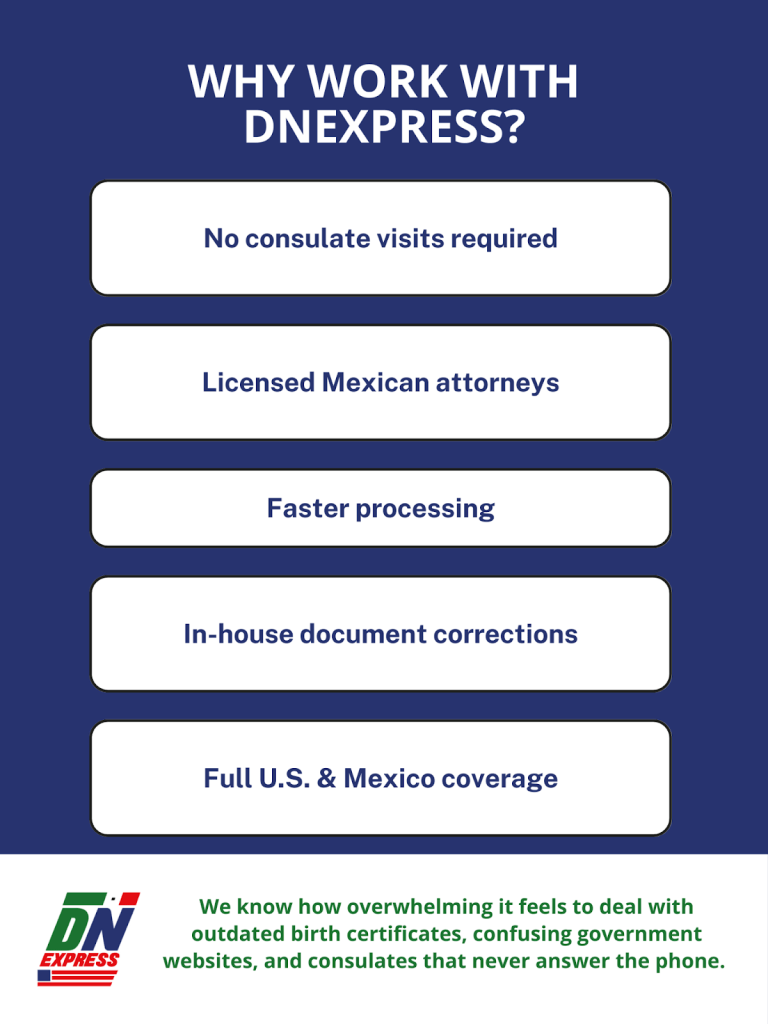

Why Work with Doble Nacionalidad Express

If you're serious about investing in property in Mexico, especially if you have Mexican roots, the first step goes beyond finding a property agent.

It's making sure your legal identity in Mexico is correct, recognized, and protected.

Doble Nacionalidad Express has built our entire service around that mission.

Benefits of Hiring DNExpress First

Licensed Mexican Attorneys, Not Paperwork Pushers

Every case is handled by actual attorneys with binational experience, not paralegals, not consultants, and definitely not a call center.

Remote Process, No Consulate Visits Needed

We specialize in helping clients complete the entire dual citizenship and legal property process 100% remotely, often without stepping foot in a consulate or courthouse.

Specialists in Dual Citizenship + Property Law

Most services do one or the other. We do both, which means we help you leverage your Mexican nationality to invest legally without fideicomisos, delays, or surprises.

Fixes Rejected or Delayed Cases

Many of our clients came to us after being denied, ignored, or stalled by the consulate. We reopen and resolve cases others gave up on, fast.

Fair Pricing & Payment Plans

We know legal services can feel out of reach for working-class families. That's why we offer transparent pricing, no hidden fees, and flexible payment options.

Client Insight

“I thought I'd have to fly to Mexico or drag my mom to the consulate. DNExpress handled everything remotely. Now I own land in Jalisco and my kids are next.” — Luis M., California

Whether you're looking to buy land for your family, generate income through rentals, or retire peacefully in the place your parents were born, the right legal help can make it possible, without wasting time or risking money.

Final Verdict: Is Buying Property in Mexico a Good Investment?

Yes, buying property in Mexico can absolutely be a smart investment.

But only if you approach it with clarity, legal support, and a long-term mindset.

It makes the most sense when you:

✅ Know the legal steps, from fideicomisos to title verification.

✅ Work with qualified professionals who know the laws on both sides of the border.

✅ Take advantage of your Mexican lineage, especially if it allows you to bypass costly restrictions.

For Mexican-Americans or U.S. citizens with family roots in Mexico, investing goes beyond financial soundness, it's a way to reclaim your place, preserve family property, and build something permanent on both sides of the border.

This goes beyond property investment.

It's cultural, legal, and generational justice.

Take Action

Want to own property in Mexico and reclaim your rightful citizenship?

You don't have to wait on the consulate, navigate legal mazes alone, or risk your family's future with the wrong paperwork.

Doble Nacionalidad Express helps you secure your dual citizenship and invest legally, all from the U.S., with qualified attorneys who know your story.

👉Schedule a Free Case Review or Message Us on WhatsApp

It's your heritage. Your investment. Your move.

We'll help you make it count.

FAQs: Smart Investor Questions Answered

Buying property in another country raises a lot of questions, especially if you're navigating Mexican laws, taxes, and inheritance rules.

Here are the most common ones we hear from clients at Doble Nacionalidad Express, answered with clarity and legal insight:

“How much money do I need to buy a house in Mexico?”

It depends on where you're looking.

Inland cities and rural areas offer properties starting around $50,000 USD, while homes in coastal destinations like Tulum or Puerto Vallarta typically start closer to $150,000 USD.

Add 4-7% in closing costs to your budget.

“Can I live in Mexico and still be a U.S. citizen?”

Absolutely. The U.S. allows dual citizenship.

If you're eligible for Mexican citizenship through your parents or grandparents, you can hold both passports legally, live full-time in Mexico, and still return to the U.S. without issue.

“What are the tax implications of owning property in Mexico?”

- Property Taxes: Low (typically $100-$500 USD/year).

- Rental Income: Must be reported in both Mexico and the U.S., although tax treaties help avoid double taxation.

- Capital Gains: If you're not a Mexican resident or citizen, you may pay capital gains taxes when selling.

Having Mexican citizenship can unlock exemptions and reduce your tax burden on gains or rental income.

“Is beachfront property a good investment?”

Yes, but only if done legally and carefully.

These high-demand areas often require a fideicomiso unless you're a Mexican citizen. Skipping steps like title verification or notary review can put your entire investment at risk.

With the right legal setup, beachfront homes can offer strong rental yields and long-term appreciation.

“Where's the best place to buy?”

The “best” location depends on your goals:

- Tulum: Eco-investments and Airbnb potential.

- Playa del Carmen: Beachfront tourism + infrastructure.

- San Miguel de Allende: Historic charm + large expat community.

- Guadalajara: Urban growth and cultural capital.

- Bacalar: Up-and-coming lakeside market.

All offer different ROI and lifestyle advantages, and dual citizenship gives you legal options in each.

“Can I pass the property to my kids if they aren't citizens?”

Yes, but the process is smoother if your children are also Mexican citizens.

Without citizenship, your heirs may face:

- Extra paperwork and taxes

- Fideicomiso restrictions

- Limited ownership rights in restricted zones

Many families work with us to secure dual citizenship for their U.S.-born kids first, then purchase property in their name, or jointly, to protect generational wealth.