Yes, property taxes in Mexico, called Predial, are mandatory for all property owners, including U.S. citizens.

However, they're typically much lower than in the U.S., calculated on a government-assessed value, and often come with early payment discounts.

Unlike in the U.S., you won't get a bill in the mail. You're expected to remember to pay.

Taxes are based on the cadastral value, not market value, which means even high-end homes can owe as little as $150/year.

Discounts are offered for early payment, and late fees can build up quickly if you forget.

If you're planning to buy, inherit, or live in a home in Mexico, especially as someone with Mexican roots or a dual citizenship path, how you handle property tax could affect your legal rights, inheritance plans, and long-term cost.

We help clients not only secure Mexican citizenship but also fix legal documents that affect home ownership, inheritance, and taxes.

Our binational legal team has helped thousands of U.S.-born Mexicans complete the entire process, no consulate visit required.

Want to learn what you owe, avoid costly mistakes, and get full legal clarity before you buy or inherit property in Mexico?

Who This Applies To: Why You're Here Matters

Whether you're eyeing a home in Mexico, planning to pass one down to your kids, or trying to figure out your tax obligations as a dual national, the situation affects everyone differently.

The truth is, property taxes in Mexico affect everyone differently, depending on your legal status and family history.

Born in the U.S. to Mexican Parents

You may be eligible for Mexican citizenship, even if your parents never registered you in Mexico.

Once you have it, you can own property directly, without needing a fideicomiso (bank trust).

This not only lowers long-term costs but makes inheritance planning smoother and gives you access to legal protections only citizens get.

To Pass Citizenship to Your Children

Registering your U.S.-born children as Mexican citizens can open the door to clean property transfers, eliminate inheritance hurdles, and protect them from foreign buyer penalties.

It's one of the smartest moves you can make for your family's financial future in Mexico.

To Live, Invest, or Retire in Mexico

If you're relocating or investing, you'll face Predial, capital gains, and closing costs.

Structuring ownership correctly from the start, especially if you plan to relocate to Mexico or sell later, can help minimize taxes and avoid legal surprises.

Dual citizenship often unlocks exemptions and better protections for long-term residents.

Previously Denied or Confused by the Process

If you've tried going through the consulate, or gave up because the process was too confusing, many people face this challenge.

Many clients come to us after misinformation, delays, or rejection, not realizing how citizenship status changes everything from ownership rights to tax rates.

To Fix Legal Documents or Inconsistencies

If your name is spelled differently across documents, or your birth record has errors, those details can block property transfers, tax payments, or inheritance claims.

We've helped thousands fix these issues and clear the legal path to full ownership, registration, and peace of mind.

What Is Property Tax (Predial) in Mexico?

Predial is Mexico’s annual property tax, based on a government-assessed cadastral value. It’s typically low and paid to local municipalities.

That means the exact amount and process can vary by city or state.

Mexico has property taxes, and they apply to everyone, including U.S. citizens and dual nationals.

How Is Predial Calculated?

Mexican property taxes are based on the cadastral value of the property, a value determined by the municipality based on location, size, age, and use.

This is not the same as the market value (what you'd sell the home for).

In most cases, the cadastral value is far lower, which is why taxes in Mexico often seem shockingly low to Americans.

For example, a property worth $600,000 USD might have a cadastral value that results in a yearly tax bill of $150–$250.

Why Is It Cheaper Than in the U.S.?

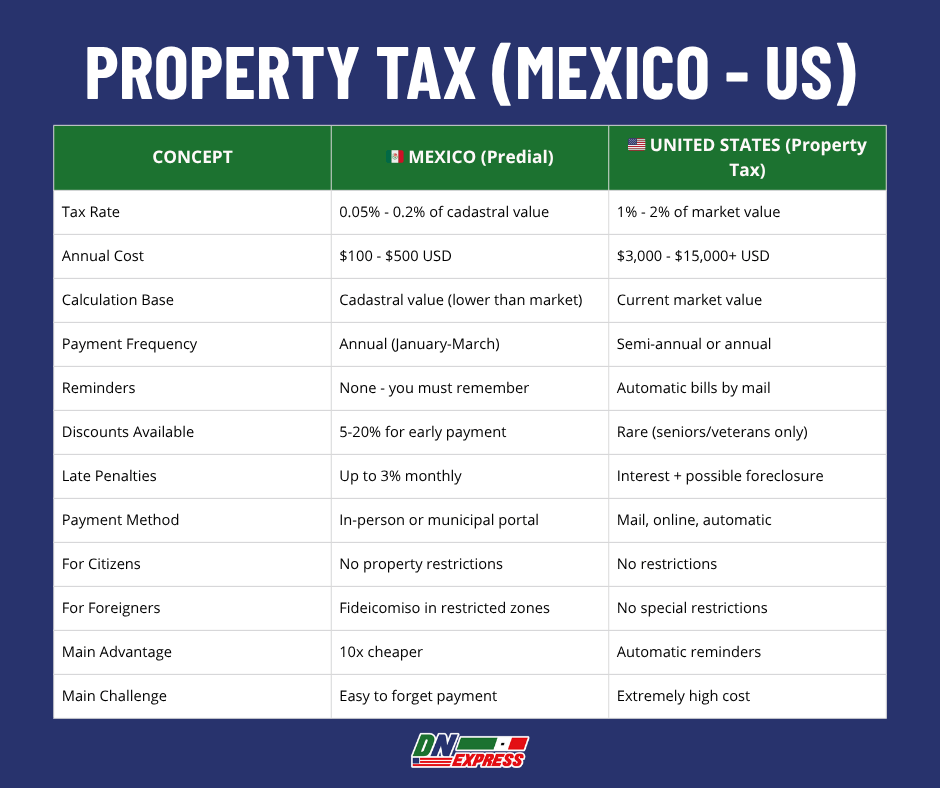

Unlike the U.S., where taxes are typically 1%–2% of market value annually, Mexico's Predial rates are between 0.05% and 0.2% of the cadastral value, depending on your municipality.

Some even calculate it in pesos per thousand (e.g., 6.5 pesos per 1,000 pesos of value).

The result? A fraction of what Americans are used to paying.

Early Payment Discounts

If you pay your Predial in January or February, you could receive a 5–20% discount, depending on your local government.

This is one of the easiest ways to save, yet most foreigners miss it because they don't know the deadline exists.

Penalties for Late Payment

Miss the deadline?

Municipalities charge monthly penalties (up to 3% in some areas).

You may also face interest, legal action, or issues when trying to sell or transfer the property.

And no, Mexico won't send you a bill in the mail.

No Reminders, You're On Your Own

Unlike the U.S., where property tax procedures send reminders like clockwork, Mexican municipalities rarely send notices.

You need to remember the due date and manually pay, either in person or through a local online portal (which can be glitchy or unavailable in smaller towns).

Additional Taxes You Might Encounter

While Predial is the most common property tax in Mexico, it's not the only cost you'll face when buying, selling, or renting property.

Here's a breakdown of other taxes that catch many people off guard, especially expats unfamiliar with Mexico's legal and financial systems.

ISAI: The Property Acquisition Tax

Impuesto Sobre Adquisición de Inmuebles (ISAI) is a one-time tax you'll pay when purchasing property.

It typically ranges from 2% to 5% of the assessed (not market) value, depending on the state or municipality.

Pro Tip: ISAI is paid at the time of closing and is often included in the list of closing costs provided by your notario.

Capital Gains Tax (ISR)

If you decide to sell your property, be prepared for capital gains tax, known as ISR (Impuesto Sobre la Renta).

There are two options:

- 25% on the gross sales price

- Up to 35% on the net gain (with deductions for improvements, costs, etc.)

And here's the twist: even if you think you're selling at a loss in USD, the tax is calculated in pesos.

That means currency shifts can make your “loss” look like a “gain” on paper.

Client Experience:

“Why is the notario charging us 25% even though we're selling at a loss?”

The sale is taxed based on peso value at purchase vs. sale. If the peso dropped in value, the system may show a taxable gain, even if you lost money in dollars.

Rental Income Tax

Renting your property?

You'll owe 25% on gross rental income, with no deductions unless you have a Mexican tax ID (RFC) and are filing under a special regime.

Many expats renting short-term (like through Airbnb) miss this—triggering issues with both Mexican and U.S. tax authorities.

Closing Costs

Beyond the purchase price, buyers should plan for 6–10% in closing costs, which include:

- ISAI

- Notary fees

- Registry fees

- Fideicomiso setup (if needed)

- Legal and documentation support

For higher-end homes, these numbers can add thousands of dollars to your upfront costs.

If you're buying or selling in Mexico, it's not only about finding the right property, it's about getting the taxes right.

A small mistake in how you record value, register ownership, or structure a sale can cost you thousands or delay your closing.

Owning Property as a Foreigner vs. Mexican Citizen

If you're a U.S. citizen planning to buy property in Mexico, the rules change depending on your legal status.

Whether or not you hold Mexican citizenship can directly affect how you own, what it costs, and what your rights look like, especially in popular beach areas.

Foreigners Must Use a Fideicomiso in Restricted Zones

Under Article 27 of the Mexican Constitution, foreigners cannot directly own property within 50 km of the coastline or 100 km from an international border.

Instead, you must set up a fideicomiso, which is a bank-managed trust that holds the property on your behalf.

The bank acts as trustee, but you maintain full usage and control.

That said, it adds complexity.

- Setup fees: $500–$1,500 USD

- Annual maintenance: ~$500 USD/year

- Requires renewal and legal upkeep

Why Some People Worry: “Is the Bank Trust a Scam?”

It's not a scam, but many buyers feel blindsided by the cost and formality.

The fideicomiso doesn't give the same legal simplicity as outright ownership.

And because it's not well-explained during transactions, many Americans find out about foreign investment regulations after they've already committed.

Citizens Can Own Outright

If you're a Mexican citizen (even if dual), you can buy anywhere in Mexico without a fideicomiso.

This simplifies ownership, cuts long-term costs, and gives you direct control over the title, which becomes especially relevant when:

- Passing the property to heirs

- Filing taxes

- Selling the home in the future

Tax Exemptions and Legal Benefits

Citizenship (or in some cases, permanent residency) can qualify you for Predial discounts, inheritance tax relief, and primary residence capital gains exemptions.

It also reduces your legal exposure when transferring property or resolving disputes.

If you're unsure whether you qualify for citizenship, or if a fideicomiso is the right move, we can help.

We guide clients through legal ownership structures, citizenship recovery, and title protections before they buy. For common questions about Mexican citizenship, we provide comprehensive guidance.

Is Buying Property in Mexico a Smart Move?

Many Americans and Mexican-Americans are drawn to Mexico for its warm climate, vibrant culture, and low cost of living, but what about the real estate investment itself?

Is it worth it?

Like most things in Mexico, the answer depends on how prepared you are.

Here's what you need to know before you buy.

Pros: Why Many Say “Yes”

- Low Annual Property Tax: With Predial rates based on cadastral value, many property owners pay $150–$500 USD/year, even on high-value homes.

That's a fraction of U.S. rates.

- Affordable Cost of Living: Everything from groceries to construction labor is cheaper, stretching your retirement income or rental revenue further.

- Capital Appreciation in Tourist Zones: Coastal and colonial hotspots like Puerto Vallarta, Tulum, Mérida, and San Miguel de Allende have seen double-digit growth in property values over the last decade.

Pro Tip: If you plan to rent part-time, many properties can pay for themselves, make sure you know the tax rules.

Cons: What You Shouldn't Ignore

- Foreign Ownership Restrictions: If you're not a Mexican citizen, you'll need a fideicomiso in coastal and border zones.

It adds cost, paperwork, and long-term bank involvement.

- Complex Legal Paperwork: Property deeds, tax records, inheritance claims, all require accurate Spanish documents and notarial oversight.

- Foreign investment property rights in Mexico: can be complex, and errors are frequent and costly.

- Unreliable Online Payment Systems: Some municipalities don't have online portals for tax payments, or the portals crash, glitch, or require a CURP (Mexican ID number) to access.

This makes it hard to manage payments from abroad.

Dual Citizenship = Tax Benefits + Legal Protection

If you're eligible for Mexican citizenship through your parents or grandparents, securing it goes beyond cultural identity, it's a powerful legal tool that can protect your property, reduce your taxes, and simplify your life on both sides of the border.

Here are the benefits of Mexican citizenship:

No Need for a Fideicomiso

Mexican citizens can own land outright, even in restricted zones like beachfront areas, without needing a fideicomiso.

That alone saves you $500/year in trust fees, plus setup costs and legal oversight.

You get a clean title in your name with full legal rights.

Lower Long-Term Costs

No trust fees. Fewer foreign buyer complications. Easier registration.

And potentially lower capital gains taxes if you can prove the property was your primary residence, something only citizens or residents can typically claim.

Easier Inheritance

When you're a citizen, you can pass property to family without foreign asset restrictions, and often without inheritance tax (which Mexico does not impose on close relatives).

If you're not a citizen, your heirs may face barriers, fees, or delays.

Capital Gains Exemption as a Primary Residence

Citizens and legal residents who can prove the property is their primary home may qualify for full or partial capital gains exemption when they sell.

This benefit, along with other tax treaty benefits, is not usually available to foreigners, even if they've lived there full-time.

Avoid Being Treated as a “Foreigner” in Transactions

Foreign buyers often get flagged for higher scrutiny, longer closing timelines, and stricter capital flow regulations.

Citizens don't face those barriers.

You're treated like a local, which speeds up everything from permits to tax approvals.

Getting dual citizenship may sound like a long process, but it doesn't have to be.

We have helped thousands of U.S.-born Mexicans get their Mexican nationality, all without visiting the consulate.

It's about securing your place, your property, and your legacy. Our comprehensive citizenship and residency services cover every aspect of your journey.

Why Choose Doble Nacionalidad Express (DNExpress)?

If you're serious about owning property in Mexico, or passing it down to your kids, legal clarity is non-negotiable.

You need your documents in order, your taxes compliant, and your ownership protected under Mexican law.

That's where we come in. We specialize in dual citizenship, document correction, and legal identity restoration for Mexican-Americans.

We're not document preparers, we're licensed, binational attorneys.

Here's What Sets Us Apart:

- Licensed Attorneys, Not Middlemen We don't fill out forms, we advise, represent, and defend your legal rights in Mexico and the U.S.

- Fixing the Issues That Stall Your Property Plans Incorrect names on birth certificates. Missing apostilles. Mismatched IDs.

These are the errors that derail tax filings, stop inheritance, and block property transfers.

We fix them, permanently.

- No Consulate Visit Required We've helped clients in all 50 states secure dual citizenship completely remotely, using our proven legal process.

- Thousands of Cases Resolved From first-generation immigrants to grandchildren of Mexican nationals, we've guided families through even the most complicated histories.

- Affordable, Bilingual Legal Support You'll get Spanish-English legal representation, document help, and strategic tax guidance from a team that knows both sides of the border.

Why DIY Can Backfire

- We've seen the cost of “doing it yourself”:

- Missed Deadlines & Expired Paperwork Mexican agencies don't send reminders, you're expected to know every timeline.

- Legal Confusion Learning “Cédula Catastral” or “Acta de Posesión” takes formal training, and a translation app won't cut it.

- Rejected Applications One wrong word on a birth certificate translation can void your entire citizenship process.

- Overpaying Taxes Without proper ownership structure, you could pay double in capital gains or miss exemptions.

- No Legal Recourse If something goes wrong with DIY filings, you're on your own.

- No lawyer. No refund. No one to call.

Get Legal and Tax-Ready Today

We protect your future in Mexico, legally, financially, and culturally. Don't wait until tax season or closing day to find out you're not ready.

If you're planning to buy, live in, or pass down property in Mexico, the best time to secure your legal identity, and correct your documents, is now.

We've seen too many families blindsided by avoidable tax bills, stalled inheritance claims, and legal chaos, all because no one told them that a birth certificate error or missing CURP could derail everything.

Doble Nacionalidad Express is here to help you:

- Get Mexican citizenship without stepping into a consulate

- Fix the documents that block property transactions or tax filings

- Learn your legal rights as a property owner with dual nationality

- Make sure your investment, and your legacy, is protected on both sides of the border

You don't have to do this alone.

Our binational legal team is ready to guide you, with clear answers, honest timelines, and affordable solutions that respect your family's story.

✅ Schedule a Free Case Review with DNExpress 📱 Call or Message Us on WhatsApp

Let's make sure your future in Mexico starts with confidence, not confusion.

Frequently Asked Questions

Is it a good idea to buy property in Mexico?

Yes, if you know the legal and tax structure. With the right support, it can be a high-value, low-maintenance investment.

Do Americans pay property tax in Mexico?

Yes. All property owners, regardless of citizenship, must pay Predial.

What taxes do you have to pay in Mexico?

Predial (annual property tax), ISAI (purchase tax), capital gains if selling, and rental income tax if renting.

Is social security taxed if you live in Mexico?

U.S. Social Security is not taxed by Mexico under the US-Mexico tax treaty. However, it may still be taxed by the IRS if you're a U.S. citizen.

Do you have to pay taxes in Mexico if you have dual citizenship?

Yes, but citizenship simplifies the process, cuts unnecessary costs, and unlocks legal and financial protections. Learn more about the tax implications of dual citizenship.

Can a U.S. citizen own a home in Mexico?

Yes.

But in coastal or border zones, you must use a fideicomiso..

How much are property taxes in Mexico?

Typically $100–$500 USD per year, depending on location and cadastral value.

How are taxes in Mexico compared to the U.S.?

They're much lower, often 10x cheaper due to how values are assessed.

What happens if you don't pay property taxes in Mexico?

You'll accrue monthly penalties and could be blocked from selling or inheriting the property until taxes are cleared.