If you’re a U.S. citizen with Mexican ties, dual citizenship, property, or plans to retire, you only pay Mexican taxes if you’re considered a tax resident. Residency means 183+ days in Mexico or significant economic ties like a home or business.

But tax rules vary depending on your situation.

Dual citizens living in the U.S. often have no Mexican tax obligations.

Retirees spending most of the year in Mexico may owe taxes on worldwide income. Property owners, remote workers, and those reclaiming Mexican nationality all face different rules and filing requirements.

We help U.S. citizens of Mexican descent not only reclaim their nationality but also navigate the tax implications confidently. Our binational legal team guides you through tax residency rules, RFC (Tax ID) setup, and avoiding costly mistakes.

Keep reading for a full breakdown of Mexico’s tax system for U.S. citizens, including income tax rates, property taxes, double taxation agreements, and when you do (and don’t) have to file.

Does It Differ Based on Your Situation?

Mexican tax laws aren’t one-size-fits-all. Whether you’re reclaiming citizenship, planning to retire, or helping your U.S.-born children secure nationality, your tax obligations depend on where you live, how long you stay, and whether you earn income in Mexico.

Here’s what you need to know based on your situation:

U.S.-Born Children of Mexican Parents

- No Mexican tax filing unless they live in Mexico more than 183 days per year or earn Mexican income.

- Parents often choose to get their child an RFC (Mexican Tax ID) early to make future property purchases or banking easier.

Adults Reclaiming Their Mexican Nationality

- Simply reclaiming your nationality doesn’t trigger tax obligations.

- However, if you own property, start a business, or spend significant time in Mexico, you could be considered a tax resident and owe taxes on global income..

Parents Applying for U.S.-Born Children

- Children aren’t subject to Mexican taxes unless they’re earning income there.

- Parents managing property or other Mexican assets on behalf of their kids may need to obtain an RFC.

Retirees Planning to Live in Mexico

- Spending 183+ days in Mexico? You’ll likely become a tax resident.

- Tax residency means your worldwide income, including U.S. pensions and investments, could be subject to Mexican taxes without proper planning.

Mexican-Americans Correcting Documents for Citizenship

- Fixing birth certificates or registry issues has no tax impact unless you also own property or earn income in Mexico.

- Getting an RFC is wise if you plan to invest or live in Mexico later.

Understanding Mexico’s Tax Residency Rules

Mexico doesn’t tax U.S. citizens simply for holding dual citizenship. Instead, the key factor is tax residency, and understanding it can save you from unexpected tax bills.

What Is the 183-Day Rule in Mexico?

If you spend 183 days or more in Mexico during a calendar year, you're considered a tax resident.

We help you understand that residency means Mexico can tax you on your worldwide income, not only income earned within the country.

But physical presence isn’t the only trigger. You may also be seen as a tax resident if:

- Your “center of vital interests” is in Mexico (spouse, children, or primary home).

- You own and manage a business in Mexico.

- Your principal economic activities shift to Mexico.

So yes, living part-time or owning property alone doesn’t necessarily make you a tax resident. But extended stays or significant ties often do.

“I thought getting dual citizenship meant I’d automatically owe Mexican taxes. DNExpress explained it’s really about residency. That clarity helped me plan my retirement without stress.”

Mexico Tax Rates for U.S. Citizens

If you’re a U.S. citizen living or earning income in Mexico, your tax rate depends on your residency status.

Mexico’s tax system treats residents and non-residents differently, knowing where you fall can save you from overpaying (or underreporting).

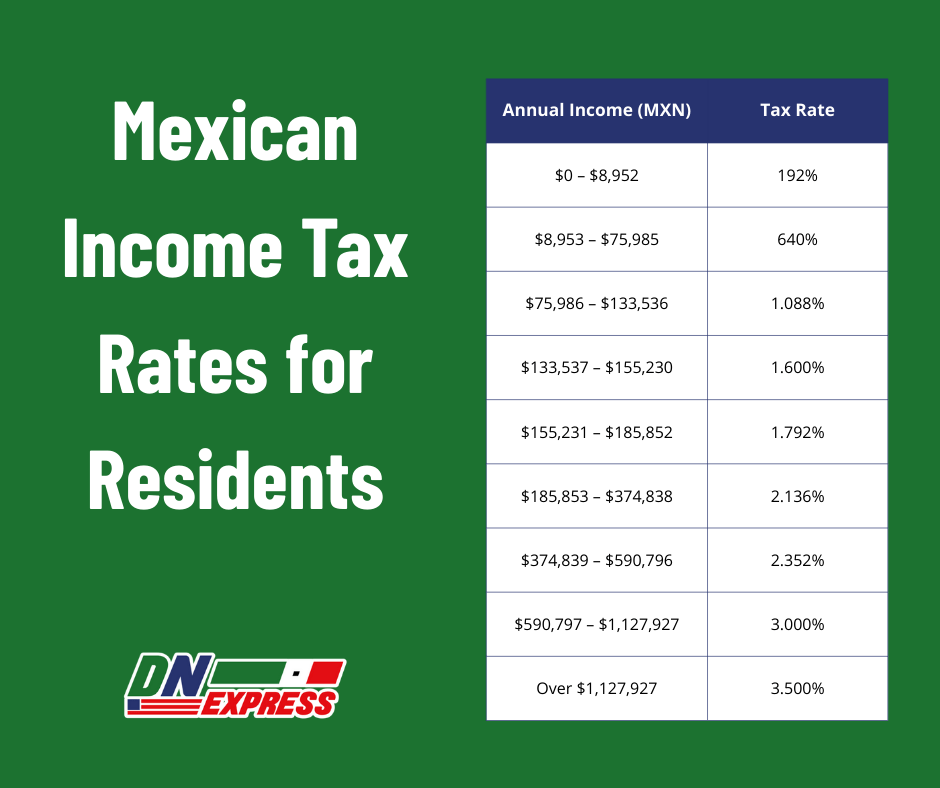

Mexican Income Tax Rates for Residents

Residents are taxed on worldwide income using a progressive tax system. Here’s what that looks like:

| Annual Income (MXN) | Tax Rate |

| $0 – $8,952 | 1.92% |

| $8,953 – $75,985 | 6.40% |

| $75,986 – $133,536 | 10.88% |

| $133,537 – $155,230 | 16.00% |

| $155,231 – $185,852 | 17.92% |

| $185,853 – $374,838 | 21.36% |

| $374,839 – $590,796 | 23.52% |

| $590,797 – $1,127,927 | 30.00% |

| Over $1,127,927 | 35.00% |

Example:

If you earn $1M MXN ($57,000 USD), your tax rate would fall into the 30% bracket for the portion of income above $590,797 MXN.

Non-Residents: Simpler but Still Taxed

Non-residents only pay taxes on Mexico-sourced income (like rental income or business earnings). Rates are:

- 15% on income from $125,900 to $1M MXN.

- 30% on income over $1M MXN.

Quick Answer: How much tax do expats pay in Mexico?

It depends. If you’re a tax resident, your global income is subject to Mexico’s rates. Non-residents are taxed only on Mexico-sourced income, often at flat rates.

U.S. Tax Obligations While in Mexico

Holding dual citizenship or living in Mexico doesn’t let you off the hook with the IRS.

As a U.S. citizen, you’re required to file U.S. taxes annually, no matter where you live or earn income. But the good news? Careful planning and tax treaties can help you avoid paying taxes twice.

Are Dual Citizens Taxed Twice?

Not usually.

Thanks to the U.S.-Mexico Tax Treaty and the Foreign Tax Credit (FTC), most dual citizens can offset taxes paid to Mexico against their U.S. tax liability.

This prevents double taxation on the same income.

What About Social Security?

Your U.S. Social Security benefits aren’t taxed by Mexico. You’ll still pay U.S. taxes on them, but Mexico won’t take a cut.

Do I Still File U.S. Taxes?

Yes. All U.S. citizens must file a federal tax return every year, even if:

- You live full-time in Mexico.

- Your income is below U.S. thresholds.

- You’ve paid taxes in Mexico already.

Pro Tip: You may qualify for the Foreign Earned Income Exclusion (FEIE), which lets you exclude up to $126,500 (2024) of foreign-earned income from U.S. taxes.

Special Cases: Owning Property or Retiring in Mexico

For U.S. citizens with Mexican ties, property ownership and retirement plans often come with unique tax considerations. Here’s what you need to know before making life-changing decisions.

Property Rental Income

If you earn income from renting out property in Mexico, it's taxable under Mexican law.. This includes:

- Federal income tax on rental profits.

- 16% Value Added Tax (IVA) applied to most rentals.

- Possible local property taxes depending on the state.

SAT (Mexico’s tax authority) increasingly monitors Airbnb and rental platforms for tax compliance.

Selling Property in Mexico

When you sell Mexican real estate as a non-resident:

- You can choose between:

- A flat 25% tax on the gross sales price.

- A 30% tax on the net gain (sale price minus original cost and allowable deductions).

- Residents pay capital gains tax on worldwide property sales, while non-residents are taxed only on Mexican property sales.

Retirees: U.S. Pensions in Mexico

Good news for retirees:

- U.S. pension income (401k, IRA, Social Security) is not taxed in Mexico unless it’s earned from Mexican sources.

- However, it remains taxable in the U.S., so plan accordingly.

Pro Tip: Spending more than 183 days in Mexico could shift you into tax residency, potentially taxing your other global income there too.

Frequent Worries (and the Truth)

Many U.S. citizens of Mexican descent feel anxious about the tax implications of dual citizenship. Let’s clear up the most frequent fears with the facts:

“Do I Need to File Mexican Taxes as a Dual Citizen?”

No. Citizenship alone doesn’t trigger tax obligations. You only need to file if you become a Mexican tax resident (by living there over 183 days or having significant economic ties).

“Will SAT (Mexico’s Tax Authority) Come After Me?”

Not likely. Non-residents aren’t targeted unless they earn Mexican-sourced income (like rental profits or business earnings).

“I Don’t Speak Spanish. How Do I Deal with SAT?”

You don’t have to. Doble Nacionalidad Express provides bilingual legal support and handles all interactions with Mexican authorities, so you can stay stress-free.

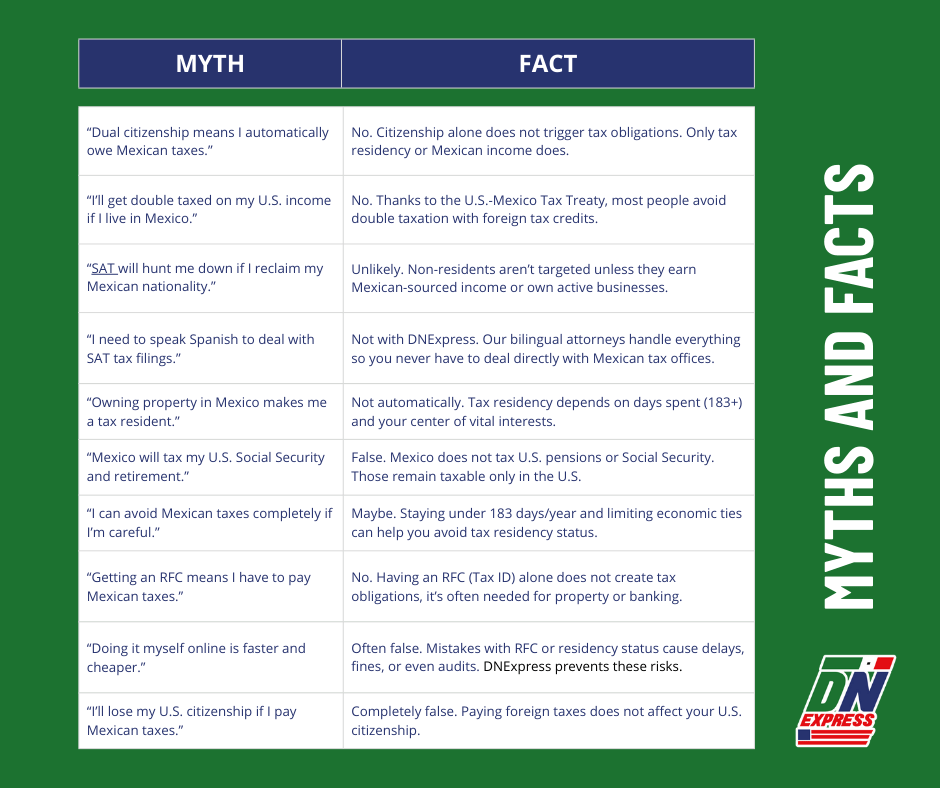

Many U.S. citizens with Mexican ties hesitate to reclaim their nationality because of tax concerns. Let’s separate myth from reality:

| Myth | Fact |

| “Dual citizenship means I automatically owe Mexican taxes.” | No. Citizenship alone does not trigger tax obligations. Only tax residency or Mexican income does. |

| “I’ll get double taxed on my U.S. income if I live in Mexico.” | No. Thanks to the U.S.-Mexico Tax Treaty, most people avoid double taxation with foreign tax credits. |

| “SAT will hunt me down if I reclaim my Mexican nationality.” | Unlikely. Non-residents aren’t targeted unless they earn Mexican-sourced income or own active businesses. |

| “I need to speak Spanish to deal with SAT tax filings.” | Not with DNExpress. Our bilingual attorneys handle everything so you never have to deal directly with Mexican tax offices. |

| “Owning property in Mexico makes me a tax resident.” | Not automatically. Tax residency depends on days spent (183+) and your center of vital interests. |

| “Mexico will tax my U.S. Social Security and retirement.” | False. Mexico does not tax U.S. pensions or Social Security. Those remain taxable only in the U.S. |

| “I can avoid Mexican taxes completely if I’m careful.” | Maybe. Staying under 183 days/year and limiting economic ties can help you avoid tax residency status. |

| “Getting an RFC means I have to pay Mexican taxes.” | No. Having an RFC (Tax ID) alone does not create tax obligations, it’s often needed for property or banking. |

| “Doing it myself online is faster and cheaper.” | Often false. Mistakes with RFC or residency status cause delays, fines, or even audits. DNExpress prevents these risks. |

| “I’ll lose my U.S. citizenship if I pay Mexican taxes.” | Completely false. Paying foreign taxes does not affect your U.S. citizenship. |

Why Work With Doble Nacionalidad Express?

Reclaiming your Mexican citizenship and navigating cross-border tax rules can feel overwhelming.

That’s why thousands of Mexican-Americans trust Doble Nacionalidad Express to make the process simple, secure, and stress-free.

DNExpress Benefits

- Skip the consulate: Get your citizenship without stepping foot in Mexico.

- Licensed Mexican attorneys manage every step, not merely paperwork processors.

- Full bilingual support for RFC (Tax ID), property transactions, and tax residency guidance.

- Private and secure: Your documents stay protected, no third parties involved.

Risks of Doing It Yourself

- Endless waitlists at Mexican consulates.

- Language barriers with SAT and legal offices.

- Mistakes on tax residency status could lead to audits or penalties.

- Complex RFC and CURP requirements cause costly delays.

Ready to Simplify Your Life?

Work with binational legal experts who know both sides of the border. We’ll help you reclaim your nationality and avoid tax pitfalls with confidence.

Schedule a Free Case Review or Message Us on WhatsApp now.

FAQ: Fast Answers to Top Questions

Do Americans Have to Pay Taxes in Mexico?

Only if you’re considered a Mexican tax resident or earn income from Mexican sources like rental properties or local business activities.

How Long Can You Stay in Mexico Without Paying Taxes?

Up to 183 days per year as a tourist. Staying longer may trigger tax residency and global income reporting requirements.

Does Mexico Tax U.S. Retirement Income?

No. Pensions like Social Security, 401(k), and IRA distributions are not taxed by Mexico unless they’re earned within the country.

What Is the 183-Day Rule?

Spend more than 183 days in Mexico in a calendar year? You’re considered a tax resident, and Mexico can tax your worldwide income.