Getting a Mexican Tax ID (RFC) is one of the first steps if you plan to work, invest, or even inherit property in Mexico.

Issued by SAT, it functions like a Social Security Number in the U.S. but also serves as your tax compliance key for payroll, banking, and electronic invoices.

We specialize in helping families and individuals navigate these situations without endless delays or consulate visits.

Our licensed attorneys ensure your documents are correct, your application is valid, and your case is handled legally from start to finish.

If you're ready to learn the process step by step, keep reading. We'll break down what an RFC is, how to get it, and how to avoid mistakes that cost people time and money.

What is a Tax ID Number in Mexico?

A Mexican Tax ID is officially called the RFC (Registro Federal de Contribuyentes).

It's issued by SAT (Servicio de Administración Tributaria), Mexico's version of the IRS.

Every taxpayer, whether an employee, freelancer, or business, uses their RFC to file taxes, issue invoices, and prove compliance in financial or legal transactions.

Think of the RFC as Mexico's equivalent to a Social Security Number (SSN) o Individual Taxpayer Identification Number (ITIN) in the United States.

Like an SSN, it identifies individuals, but it also functions like an EIN (Employer Identification Number) because businesses (personas morales) get their own RFC too.

You'll need an RFC in the following cases:

- Employment: Every job contract and payroll slip in Mexico requires an RFC.

- Business & Freelancing: To issue official tax invoices (facturas) or register a company.

- Property & Investments: To buy real estate, open a bank account, or invest in Mexico's financial system.

- Residency & Immigration: Foreign residents often need an RFC to validate legal and financial activity.

In short: the RFC goes beyond paying taxes. It's the key that unlocks your ability to work, bank, and invest legally in Mexico.

El Federal Taxpayer Registry has been a cornerstone of Mexico's tax system for decades, evolving to meet modern economic needs.

How to Get a Mexican Tax ID (RFC)

The process of getting an RFC depends on whether you are a Mexican citizen, a foreign resident, or a dual citizen reclaiming nationality.

While the steps are similar, the required documents can vary.

For Mexican Citizens (in Mexico or Abroad)

- Inside Mexrico: Apply online with your CURP (Clave Única de Registro de Población), then confirm in person at a SAT office. Bring official ID, proof of address, and a USB to store your digital certificate.

- Outside Mexico: Mexican consulates may assist, but appointments are often delayed. Many clients prefer private attorney-led services to avoid consular backlogs.

The Mexican Foreign Ministry and SAT now offer remote RFC registration for Mexicans living abroad, making the process more accessible.

For Foreigners with Residency or Work Permits

Foreign residents can apply for an RFC once they have a temporary or permanent residency visa.

Required documents include:

- Valid passport and residency card.

- Proof of address in Mexico.

- CURP (issued once residency is granted).

This RFC is vital for opening bank accounts, purchasing property, or registering as self-employed.

Special Notes for Dual Citizens

If you were born in the U.S. but have Mexican parents or grandparents, you qualify for Mexican nationality.

Once you reclaim citizenship, you can register for a CURP and then obtain your RFC like any Mexican citizen.

Many people are surprised to learn they qualify, even if the consulate initially rejected them.

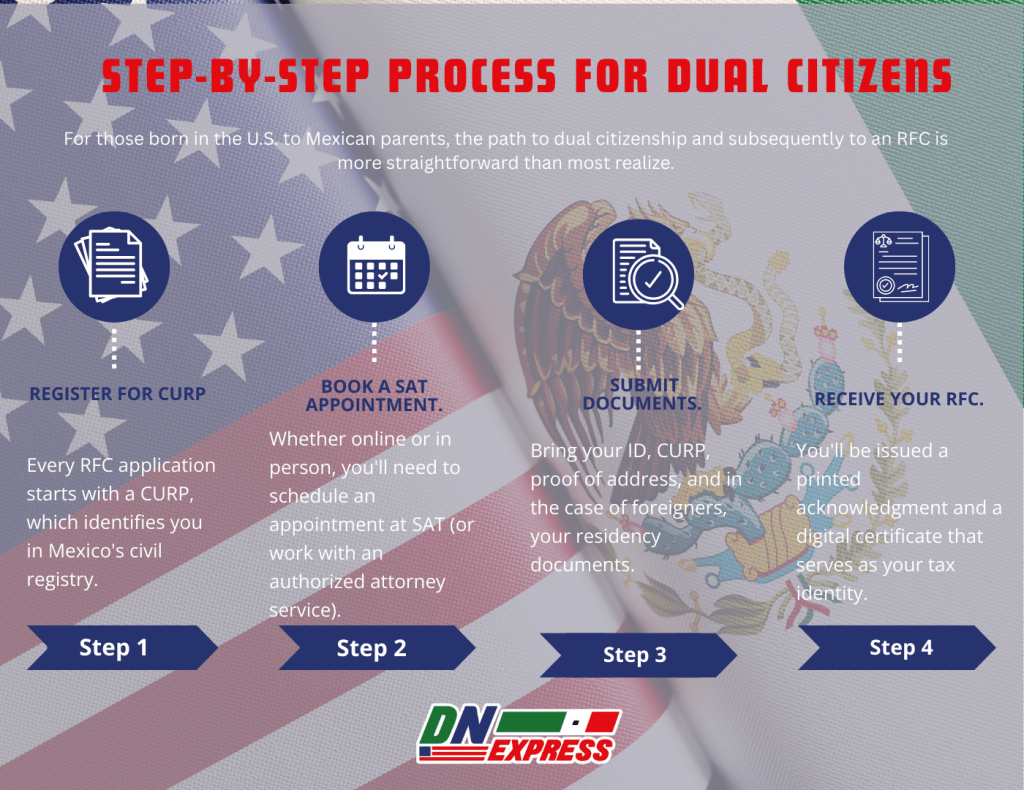

For those born in the U.S. to Mexican parents, the path to dual citizenship and subsequently to an RFC is more straightforward than most realize.

Step-by-Step Process

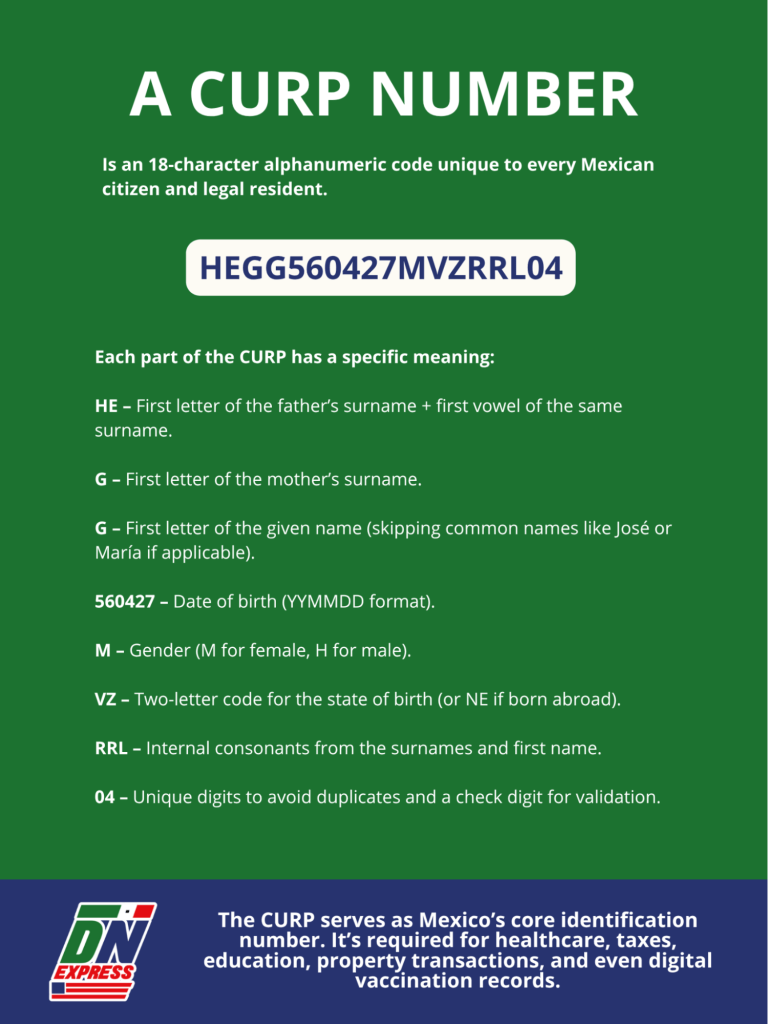

- Register for CURP. Every RFC application starts with a CURP, which identifies you in Mexico's civil registry.

- Book a SAT Appointment. Whether online or in person, you'll need to schedule an appointment at SAT (or work with an authorized attorney service).

- Submit Documents. Bring your ID, CURP, proof of address, and in the case of foreigners, your residency documents.

- Receive Your RFC. You'll be issued a printed acknowledgment and a digital certificate that serves as your tax identity.

While the RFC is free, mistakes in paperwork can cause months of delay. Working with us, ensures your documents are corrected, your case is attorney-reviewed, and your RFC is processed without the consulate headaches.

Can a Foreigner Get a Tax ID Number in Mexico?

Yes, foreigners can and often must get a Mexican Tax ID (RFC) if they plan to own property, open a bank account, work as freelancers, or establish a business.

Without it, many financial and legal processes in Mexico simply aren't possible.

Conditions for Foreigners

To qualify for an RFC, you generally need one of the following:

- Residency Visa. Temporary or permanent residency is required. Tourists cannot apply for an RFC.

- Economic Solvency. Proof of income, investment, or business activity in Mexico.

- Family Ties. Foreign spouses, children, or parents of Mexican citizens may be eligible once their residency is granted.

How Do Immigrants Get a Tax ID?

- Obtain Residency. Apply for temporary or permanent residency through Mexico's immigration system.

- Get Your CURP. Once residency is approved, you'll receive a CURP, the ID number that unlocks the RFC application.

- Apply at SAT. With passport, residency card, and proof of address, you can book an appointment at a SAT office and request your RFC.

Many expats discover too late that they need an RFC to finalize a property purchase or sign a business contract.

By securing it early, you avoid last-minute delays.

Our legal team guides foreign residents and mixed-status families through the process, making sure residency, CURP, and RFC steps are aligned.

We also correct documentation errors that often cause SAT rejections.

For those considering Mexican citizenship from San Diego, understanding the RFC process is a valuable first step.

Where to Find Your RFC

Once your RFC is issued, it appears on several official documents you'll use in everyday life.

Knowing where to look saves time when banks, employers, or government offices request it.

Places to Find Your RFC

- Tax Returns. Your RFC is printed on all filings submitted to SAT.

- Payroll Stubs. Every paycheck in Mexico includes the employee's RFC for tax reporting.

- Digital Invoices (Facturas). The RFC of both the buyer and seller is displayed on official tax invoices used for deductions and credits.

Online Access with CURP

SAT offers an online portal where you can recover or verify your RFC using your CURP.

This is particularly useful if you misplaced your printed acknowledgment or need to validate your RFC for an employer or bank.

On Your Mexican ID Documents

If you already have a Constancia de Situación Fiscal (tax situation certificate), your RFC will be printed at the top along with your full legal name and address.

However, your RFC does not appear on your regular voter ID (INE) or passport.

If you're unsure whether your RFC is active or registered correctly, Doble Nacionalidad Express can help verify it through SAT's system, correct any errors, and make sure it matches your legal documents to avoid delays with payroll, banking, or e-invoicing.

El Mexperience RFC guide provides additional details about using your RFC for various transactions in Mexico.

Frequent Worries About the RFC

Applying for a Mexican Tax ID (RFC) often comes with stress and misinformation.

Here are the most frequent concerns we hear from clients and the truth behind them.

“What if I'm late, will I be penalized?”

While SAT does expect timely registration, penalties usually apply only if you are already earning taxable income and fail to register.

Many people apply in advance to avoid last-minute issues with employers, banks, or notaries.

“I'm confused between RFC, CURP, and consular IDs.”

This is one of the biggest sources of stress.

CURP is a personal identity code, similar to a social security number. RFC is strictly for tax and financial purposes.

Consular IDs (like Matrícula Consular) are not tax numbers and cannot replace an RFC.

“I'm a foreigner without residency, does that mean I can't apply?”

Correct: tourists cannot obtain an RFC. Only legal residents or naturalized citizens can apply.

However, many people with Mexican parents or grandparents don't realize they qualify for Mexican nationality, which then unlocks the ability to get an RFC.

“What if I make a mistake and get rejected?”

SAT is strict: mismatched names, missing accents, or inconsistent dates across documents can cause rejection.

This is where most self-prepared applications fail. The good news? These issues are fixable with the right legal process.

We specialize in cleaning up documentation errors and guiding clients through RFC registration without the long waits or frustrations of the consulate.

That way, you don't risk rejection for a simple clerical mistake.

For comprehensive answers to other common questions, visit our FAQ section.

Why Work with Doble Nacionalidad Express?

Most people try to navigate the RFC process alone, only to run into confusing rules, rejected applications, or endless consulate appointments.

We built our service to eliminate those barriers and get families across the finish line quickly and legally.

Licensed Mexican Attorneys, Not Processors

Your case is reviewed by attorneys who know both U.S. and Mexican legal systems.

That means we don't only file paperwork, we fix underlying issues that would otherwise block your RFC or nationality.

Dual Citizenship Without Consulate Visits

Consulates often demand months-long waits or impose unnecessary requirements.

With us, you don't step foot in the consulate. We handle everything remotely and directly with Mexican authorities.

Affordable, Transparent Pricing

We believe reclaiming your nationality or getting a tax ID shouldn't cost thousands.

Our pricing is fair, with flexible payment plans and a clear refund policy if your case doesn't qualify.

U.S. & Mexico Offices for Full Support

With offices in California y Tijuana, plus agents across all 32 Mexican states, we can search local records, correct errors, and resolve problems on both sides of the border.

Specialists in Difficult or Rejected Cases

Many of our clients come to us after being denied by the consulate or SAT.

From mismatched names to missing birth certificates, we've seen it all and we know how to turn “no” into “yes.”

Choosing our help means you're not only filing for an RFC. You're securing your legal identity with professionals who care about your outcome.

We also provide certified document translation services to ensure all your paperwork meets Mexican legal requirements.

DIY vs Professional Help

Some people try to apply for their RFC on their own. While it's possible, the risks often outweigh the savings.

The DIY Route

- Risk of Rejection. Small errors in names, dates, or accents often cause SAT to reject applications.

- Months of Waiting. Consulate and SAT appointments can take months to secure, delaying jobs, property purchases, or bank accounts.

- Confusing Rules. Requirements change depending on the office, and consular staff often give inconsistent instructions.

With Doble Nacionalidad Express

- Attorney-Backed Process. Licensed Mexican attorneys review every case for accuracy and compliance.

- Remote and Hassle-Free. No need to travel or wait for a consulate slot; everything is handled online and through our U.S.–Mexico offices.

- Document Corrections Included. If your birth certificate, CURP, or other records need corrections, we fix them as part of the process.

- Peace of Mind. You know your case is being handled legally, securely, and efficiently.

Instead of navigating red tape alone, you can rely on our team to make the RFC process smooth, fast, and stress-free.

Take the Next Step

Ready to secure your RFC, Mexican passport, or dual citizenship?

We've helped thousands of families reclaim their nationality, correct their documents, and obtain the IDs that open doors in Mexico.

Whether you're a U.S.-born child of Mexican parents, a foreign resident investing in Mexico, or someone who's already faced rejection at the consulate, we can guide you to a “yes.”

Schedule a Free Case Review today. Our bilingual team is available by phone, WhatsApp, or email to answer your questions and review your eligibility.

Because at the end of the day, this goes beyond a tax ID number. It's about restoring your rights, your opportunities, and your connection to Mexico.

Frequently Asked Questions About the Mexican Tax ID (RFC)

Do U.S. citizens have a Mexican tax ID?

Not automatically. A U.S. citizen only gets an RFC if they claim Mexican citizenship through parents or grandparents, or if they hold legal residency in Mexico.

Without nationality or residency, tourists cannot apply.

How to get a foreign tax ID?

Each country has its own process. In Mexico, foreigners need residency first, then a CURP, and finally an RFC from SAT.

U.S. residents may already have an ITIN or SSN, but these are not substitutes for an RFC inside Mexico.

El Wise Mexico expat tax guide explains how U.S. tax obligations interact with Mexican tax requirements for dual citizens.

What is a “constancia fiscal”?

The Constancia de Situación Fiscal is a tax certificate issued by SAT.

It shows your RFC, registered tax regime, and fiscal address. Banks, employers, and service providers often request it to verify that your RFC is valid and active.

Is there a difference between RFC and Mexican “tax code”?

In Mexico, the RFC is your tax code. Unlike the U.S., where you may have different identifiers (SSN, ITIN, EIN), Mexico uses the RFC universally for individuals and companies.

How to apply for a New Mexico tax ID?

This is a frequent point of confusion. A New Mexico tax ID refers to a state-level identification number issued in the United States (by the New Mexico Taxation and Revenue Department).

It is completely unrelated to Mexico's RFC. If you're doing business in both places, you may need both numbers.

We often see clients confused by these overlapping systems. Our attorneys clarify which ID you actually need, whether you're opening a bank account in Mexico, registering property, or handling tax obligations between both countries.

For those managing taxes as dual citizens, understanding both systems is crucial for compliance.