Foreigners and Mexican-Americans can open a business in Mexico legally. You'll need to choose a business structure, register with the SAT (tax authority), open a Mexican bank account, and follow labor and permit regulations.

Dual citizens have fewer barriers and greater legal flexibility.

Whether you're planning to run a boutique, buy property, or launch a digital business, the process depends on your legal status. Dual citizens can skip many steps required of foreigners, like immigration permits or restricted land limitations.

And if you're of Mexican descent, you may be eligible for doble ciudadanía, even if you were born in the U.S.

Con Doble Nacionalidad Express, we help Mexican-Americans and their families reclaim their nationality and legally open businesses in Mexico; no consulate appointments, no guesswork. From correcting your documents to filing your business RFC, our licensed attorneys handle everything remotely.

Want the full step-by-step breakdown, including costs, timelines, and which business types work best for U.S.-based entrepreneurs? Let's dive in.

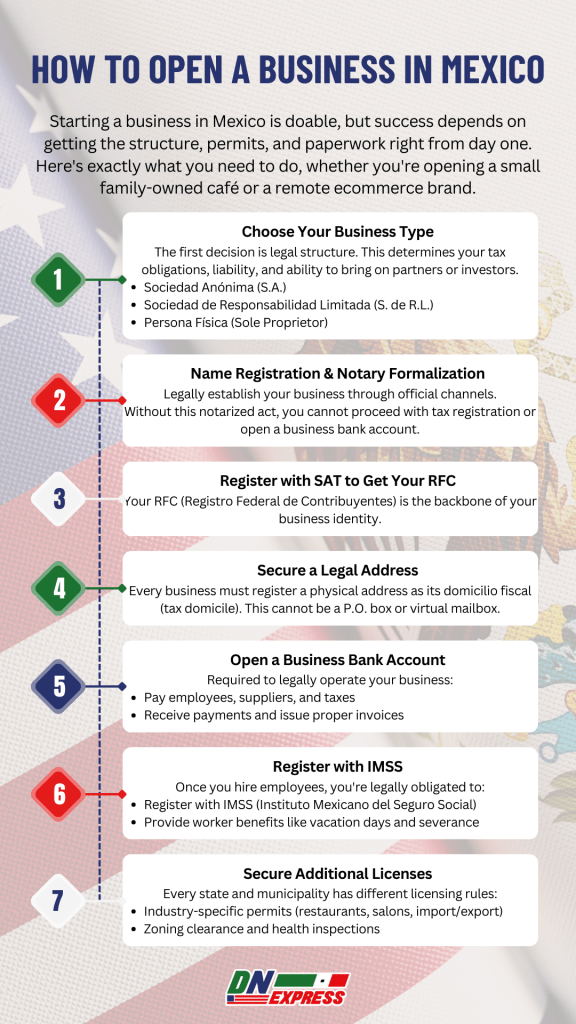

Step-by-Step: How to Open a Business in Mexico

Starting a business in Mexico is doable, but success depends on getting the structure, permits, and paperwork right from day one. Here's exactly what you need to do, whether you're opening a small family-owned café or a remote ecommerce brand.

Step 1: Choose Your Business Type

The first decision is legal structure. This will determine your tax obligations, liability, and ability to bring on partners or investors.

- Sociedad Anónima (S.A.): Ideal for larger ventures with multiple shareholders. Requires a minimum of two shareholders and a formal corporate board structure.

- Sociedad de Responsabilidad Limitada (S. de R.L.): Best for small to medium businesses. Similar to a U.S. LLC, it protects your personal assets and allows flexibility in ownership structure.

- Concern: “Can I open an LLC in Mexico?” Yes, S. de R.L. is the Mexican equivalent.

- Persona Física (Sole Proprietor): Simplest and fastest to start, but you'll be personally liable for business debts. Not ideal for high-risk or growth-focused operations.

If you're unsure which is right for you, DNExpress can review your goals and recommend the structure that offers both protection and flexibility.

Step 2: Name Registration & Notary Formalization

Once you've chosen your structure, you'll need to legally establish the business:

Submit a name reservation request to the Secretaría de Economía (Ministry of Economy).

Draft your Articles of Incorporation (Acta Constitutiva) and bylaws.

A licensed Notary Public must formalize and certify your company's formation.

Without this notarized act, you cannot proceed with tax registration or open a business bank account.

Step 3: Register with SAT to Get Your RFC (Tax ID)

Your RFC (Registro Federal de Contribuyentes) is the backbone of your business identity. It's used for:

- Issuing legal invoices (facturas)

- Paying employee payroll taxes

- Complying with monthly and annual reporting

All entities, including online businesses, must register with SAT, Mexico's tax authority.

Note: This process is in Spanish and often requires in-person appointments unless you work with an authorized legal rep, like DNExpress.

Step 4: Secure a Legal Address (Domicilio Fiscal)

Every business must register a physical address as its domicilio fiscal (tax domicile). This cannot be a P.O. box or virtual mailbox.

For brick-and-mortar businesses, this is your store or office.

For remote businesses, you'll need a legally recognized rental or shared office space.

DNExpress has agents across Mexico to help verify and register your address, even if you're not physically in the country.

Step 5: Open a Business Bank Account

To legally operate, you must open a business account in a Mexican bank. This allows you to:

- Pay employees, suppliers, and taxes

- Receive payments and issue proper invoices

- Prove financial activity for audits or permits

Step 6: Register with IMSS (Social Security)

Once you hire employees, you're legally obligated to:

- Register with IMSS (Instituto Mexicano del Seguro Social)

- Pay into the national healthcare and pension system

- Provide worker benefits like vacation days and severance pay

Failure to comply with labor laws can result in fines and legal action, even for small businesses.

Step 7: Secure Additional Licenses or Permits

Every state and municipality in Mexico has different licensing rules.

Restaurants, salons, import/export, and tourism businesses often require local permits.

You may also need zoning clearance, health inspections, or environmental approvals depending on your industry.

DNExpress helps you identify and apply for the exact permits you need based on your business model and location.

Costs, Timeframes & Money Questions

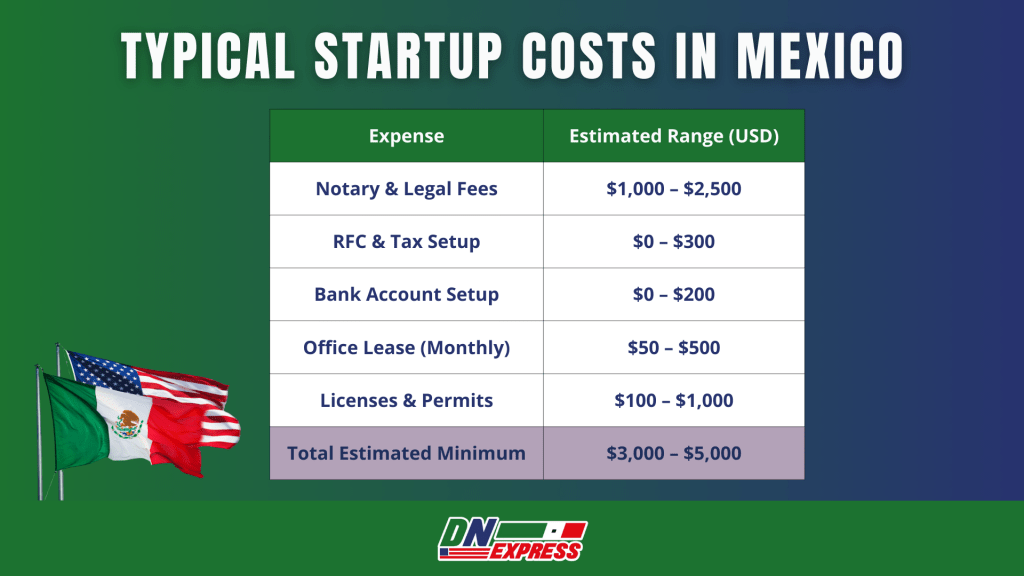

Starting a business in Mexico is significantly cheaper than in the U.S., but the actual cost depends on your business model, location, and legal status. Below is a breakdown of what most new business owners can expect to spend when doing it by the book.

Typical Startup Costs

| Expense | Estimated Range (USD) |

| Notary & Legal Fees | $1,000 – $2,500 |

| RFC & Tax Setup | $0 – $300 |

| Bank Account Setup | $0 – $200 |

| Office Lease (Monthly) | $50 – $500 |

| Licenses & Permits | $100 – $1,000 |

| Total Estimated Minimum | $3,000 – $5,000 |

These costs cover the legal setup, not inventory, branding, or marketing. That said, many DNExpress clients successfully launch with budgets under $10,000, especially for digital services, online shops, or family-run businesses.

How Long Does It Take to Start a Business?

The timeline varies based on whether you're inside Mexico, your legal status, and the type of business you're opening:

- Dual citizens: As little as 3–4 weeks, since no immigration paperwork is needed.

- Foreigners: Allow 6–10 weeks, due to visa or residency processing.

- From abroad: With a legal representative (like DNExpress), formation can be done remotely.

User concern: “How long does the whole process actually take if I'm outside Mexico?” With DNExpress, most remote clients complete setup within 30–45 days.

Can You Afford to Live in Mexico While Running a Business?

If you're relocating or running a business while living in Mexico, these common salary-related questions often come up:

“Is $1,000 USD a good salary in Mexico?” It's livable in smaller towns, but below average in major cities like CDMX or Guadalajara.

“Can I live in Mexico on $2,000–$3,000/month?” Absolutely. Most cities offer a high quality of life for expats and dual nationals within that budget.

If your business generates steady income, this range covers rent, food, transportation, and even private healthcare in most areas.

Foreigners vs. Dual Citizens: What Changes?

Your legal status in Mexico has a direct impact on how easy, fast, and flexible it becomes to start and operate a business. Here's how the process differs depending on whether you're a dual citizen or a foreign national.

If You're a Dual Citizen:

Holding both U.S. and Mexican citizenship gives you full legal rights to operate as a native business owner; no extra hoops, no immigration red tape.

- No industry restrictions: You can open any type of business, including in regulated sectors like energy, transportation, or media.

- Own land freely: Buy commercial or coastal property outright; no need for trusts or third-party arrangements.

- Streamlined tax setup: As a national, you're eligible for simplified tax regimes and don't have to report foreign investment.

- No visa required: You can live and work indefinitely in Mexico without immigration paperwork.

For U.S.-born individuals with Mexican parents or grandparents, this is often the best path, and one that DNExpress helps clients unlock every day.

If You're a Foreigner:

Foreign nationals can legally open businesses in Mexico, but with added compliance steps and a few limitations:

- Industry restrictions apply: Foreigners cannot fully own businesses in certain sectors like national transport, broadcasting, or energy.

- Immigration status is mandatory: You'll need either a temporary or permanent resident visa with work permissions.

- Banking & tax setup is trickier: Opening accounts, obtaining an RFC, and securing a tax domicile often requires a legal representative or sponsor.

- Extra reporting: Any foreign ownership must be reported to the National Registry of Foreign Investment.

User question: “Can Americans do business in Mexico?” Yes, but they must follow foreign ownership rules, secure immigration status, and stay compliant with SAT and labor laws.

Concerns for Non-Citizens

“Why is it hard to start a business?” Bureaucracy is real. Expect notarized paperwork, long appointment waits, and lots of Spanish-language documentation, which can overwhelm many first-time entrepreneurs.

“Do I need to speak Spanish?” No, but it helps. Hiring a bilingual legal team is one of the smartest moves you can make. DNExpress's attorneys are fluent in both English and Spanish and can guide you through every official step.

Practical Tips from Business Owners in Mexico

Whether you're launching from across the border or already living in Mexico, these hard-won insights can save you time, money, and serious headaches. These come from business owners who've successfully launched with and without legal guidance.

Avoid Agents Who Promise Results But Vanish

Too many expats and dual nationals have fallen into traps with unlicensed “consultants” who vanish after collecting payment. These bad actors often:

- Falsify documents

- Disappear mid-process

- Leave clients unable to fix rejected filings

Pro tip: Only work with licensed attorneys or certified legal reps. With DNExpress, all filings are handled in-house by licensed professionals with transparent pricing and timelines.

Don't Start Informally Hoping to Go Legit Later

Mexico's informal economy might look appealing, especially if you're working solo or testing an idea, but there are risks:

- You can't issue invoices (facturas)

- You'll have no access to credit or legal protections

- If caught or audited, back taxes and penalties can be steep

Starting formally from day one opens additional doors and keeps you protected. It's easier (and often cheaper) than trying to “fix” your business later.

You Don't Need to Be in Mexico: Use Power of Attorney

Opening a business from the U.S. is 100% possible with the right legal structure. DNExpress clients routinely launch businesses remotely using a Power of Attorney.

- No need to fly down for signatures

- Avoid in-person appointments at Mexican consulates

- Everything can be handled via secure digital channels

Online Businesses Face Fewer Barriers

If your business doesn't need a physical storefront, you can bypass many municipal permit requirements.

Digital services, ecommerce, consulting, and remote work are popular models.

Tax and banking requirements still apply, but zoning, inspections, and licenses are minimized.

This makes online businesses a great entry point for first-time entrepreneurs.

Choose the Right City for Your Industry

Location matters, not only for lifestyle, but for infrastructure and opportunity.

- Guadalajara: Mexico's tech and startup hub; ideal for software, innovation, and bilingual talent.

- CDMX (Mexico City): The capital offers everything, but comes with higher costs and competition.

- Tijuana & Monterrey: Great for U.S. market proximity and cross-border logistics.

- San Miguel de Allende & Mérida: Popular for tourism, hospitality, and wellness ventures.

Why Use Doble Nacionalidad Express?

Starting a business in Mexico involves navigating a legal system that wasn't built with U.S.-born applicants in mind. That's where we come in.

With Doble Nacionalidad Express, we help people of Mexican descent reclaim their nationality and launch legal businesses across Mexico, without ever stepping into a consulate or dealing with inconsistent government responses.

Why DNExpress Is the Smart Move

Con DNExpress, you're not getting a document runner or a faceless processing center. You're getting a licensed legal team that's walked thousands of Mexican-Americans through this exact process.

Here's how we do it better:

- Licensed Mexican Attorneys personally handle your business and nationality filings.

- In-house support only; no third-party contractors touching your sensitive documents.

- No consulate appointments needed; we do everything remotely.

- We specialize in tough or rejected cases, especially for clients previously turned away.

- Transparent pricing, no hidden fees, and flexible payment plans. View our pricing.

- Agents in all 32 Mexican states; we can pull local records faster than national systems.

What Happens If You DIY?

We've helped hundreds of clients who tried to do it themselves and got stuck. Here's what often goes wrong when you go it alone:

- Applications rejected due to document errors or wrong formatting

- Wasted money on shady “fixers” or agents who disappear

- Delayed timelines due to slow replies or missed appointments

- Legal exposure from improper tax or labor registration

- Stress and uncertainty over whether your case even qualifies

When your legal identity, time, and business investment are on the line, shortcuts aren't worth it.

Ready to Launch? Here's What to Do Next

Starting a business in Mexico doesn't have to be a guessing game. Whether you're reclaiming your nationality, registering your first business, or expanding across borders, we'll walk you through every step; clearly, legally, and on your terms.

Here's how to get started:

Step 1: Schedule a Free Case Review

Book a Free Case Review with our team to talk through your goals, paperwork, and timeline; no commitment required. Or Message Us on WhatsApp.

Step 2: Share Your Vision

Let us know whether you're starting a new business, reclaiming your nationality, or both. We'll confirm what you qualify for and what legal pathways are available to you.

Step 3: Let Us Handle the Rest

From document retrieval and tax registration to business formation and citizenship filings, our in-house legal team will take care of the entire process.

When you're ready to build something in Mexico, not only a business, but a lasting connection, Doble Nacionalidad Express is here to help you do it right.

You're Building Something Bigger Than a Business

If you're of Mexican descent, opening a business in Mexico goes beyond pesos and permits; it's about planting roots in a place that's part of who you are.

Con Doble Nacionalidad Express, we've helped thousands of Mexican-Americans stop feeling stuck between two countries and start building freely in both. Whether you were born in the U.S., rejected by the consulate, or told you couldn't do it, you can.

We believe that reclaiming your nationality and launching your business should be a proud, powerful moment, not a bureaucratic nightmare. That's why we've built a legal service that removes the guesswork, respects your story, and gives you the full benefits of your identity and ambition.

Your right to belong doesn't end at the border. Your business shouldn't either.

Preguntas frecuentes

Can a U.S. citizen open a business in Mexico?

Yes, Americans can open businesses in Mexico. You'll need the right immigration status and must follow foreign investment and tax rules.

Do I need Mexican citizenship to own a business in Mexico?

No, but it makes the process easier. Dual citizens can skip immigration steps and own land in restricted zones like coastal areas.

How much does it cost to register a business in Mexico?

Expect to spend $3,000–$5,000 USD for legal setup, permits, and basic operations. Costs vary by business type and location.

Can I open a business in Mexico remotely?

Yes. With Power of Attorney and a legal representative, you can register and operate a business from the U.S. through DNExpress.

What's the best business structure for small businesses?

The S. de R.L. is ideal. It's similar to a U.S. LLC and protects your personal assets while offering flexible ownership.

Do I need to speak Spanish to register a business?

Not required, but highly recommended. Legal documents and tax filings are in Spanish, so a bilingual team (like ours) is needed.

For document translation services, DNExpress offers certified translations starting at $15 USD per page.

How long does it take to open a business in Mexico?

Most clients are fully registered within 4–6 weeks. Dual citizens may finish faster, while foreigners need extra time for immigration steps.