Yes, Mexico does have property taxes called Predial. They're generally much lower than in the U.S., but come with unique rules, deadlines, and enforcement quirks.

Whether you're buying, inheriting, or renting property, understanding Mexican tax law can save you thousands.

Unlike the U.S., Mexico's property tax system operates differently. There are no escrow accounts, no mailed bills, and enforcement varies by region.

But here's what you need to know right away:

- Taxes are paid annually and based on cadastral value, not market price.

- Most owners qualify for early payment discounts.

- Skipping payment won't get you a notice, but it can block you from selling or transferring the property.

- Capital gains and rental income taxes also apply, especially for U.S. citizens and non-residents.

If you're a U.S. citizen of Mexican descent, your citizenship status can drastically change how you buy, own, or inherit property and how much tax you'll pay. That's why we help you unlock these benefits through remote, attorney-led services that get you legal in both countries.

Want to understand how this all works and how to protect your property? Keep reading. We'll walk you through the full breakdown below.

Do You Have to Pay Property Taxes in Mexico?

Yes. Here's How Mexico's Property Tax System Works

If you own property in Mexico, whether it's a vacation home, rental, or inherited land, you're legally required to pay an annual property tax known as Impuesto Predial.

And while it's often much cheaper than what you'd pay in the U.S., missing a payment can still cost you in late fees, legal trouble, or lost opportunities.

Here's what you need to know about how Predial works:

- It's based on cadastral value, not market value. This means the tax is calculated using the property's assessed value according to municipal records, which is often lower than what it would sell for on the open market.

- Rates range from 0.05% to 1.2%, depending on your municipality and whether the property is residential, commercial, or vacant land.

- It's paid annually, typically due between January and March, although exact deadlines vary by state or city.

- No one will send you a bill. Unlike in the U.S., there's no escrow system or reminder letter. You're expected to know the due date and pay proactively to the Mexican Tax Administration Service (SAT).

- You can pay online or in person at your local municipal treasury office. Some cities offer apps or portals, while others still require physical receipts.

- Early bird gets the discount. Many municipalities offer 6-20% discounts if you pay in January or February. Seniors with INAPAM cards may qualify for even larger savings.

- If you own multiple properties, or rent them out even on Airbnb, you may face higher rates or additional income taxes. We'll cover those further down the article.

Common Mistakes by New Property Owners

Many first-time buyers, especially those used to U.S. estate systems, get caught off guard by Mexico's decentralized and manual approach to property taxes. Here are the most common traps to avoid:

- Assuming there's no tax at all. Because the amounts are relatively low and there's no invoice, it's easy to think this obligation doesn't exist. But skipping it can cause problems when you try to sell, renovate, or inherit the property.

- Forgetting to open a Cuenta Catastral. This is the official tax registration account for your property. Without it, your payments won't be tracked, and services like permits or resale approvals may be delayed.

- Thinking your fideicomiso (bank trust) handles it. A fideicomiso holds the title for foreigners, but it doesn't pay your property tax for you. That's still your responsibility.

- Expecting U.S.-style mortgage escrow. In Mexico, even financed properties don't include Predial in mortgage payments. You must handle it separately.

What Makes Property Taxes in Mexico So Different From the U.S.?

Key Differences at a Glance

At first glance, México‘s property taxes might seem refreshingly low, but the system itself works very differently from what most U.S. homeowners are used to. If you're not prepared for those differences, you could face unnecessary fees, delays, or even legal headaches down the line.

Let's walk through the most significant distinctions:

1. No Escrow System: You Pay Manually

In the U.S., most mortgage lenders collect property taxes in monthly installments and pay them on your behalf through an escrow account. In Mexico, there's no escrow.

You're responsible for remembering to pay your Impuesto Predial in full, usually once a year, directly to the municipality.

2. Assessed (Cadastral) Value, Not Market Value

Mexican property taxes are based on a cadastral value, which is assessed by local government and often far below the actual market value. This keeps rates low, but also creates disparities, especially if your property is newly built or has unreported upgrades.

3. Minimal Exemptions: No Homestead Discounts

Unlike in the U.S., where primary residences often receive homestead exemptions, Mexico offers few standard deductions. That said, INAPAM cardholders (seniors over 60) may qualify for discounts. Some municipalities offer early-bird incentives for January or February payments.

4. No Reminders, But Fines Still Apply

There's no mailed notice or automatic alert system. If you forget to pay, you'll still owe late penalties, interest, and fines. You may be blocked from selling or transferring the property until the debt is cleared.

5. Capital Gains Tax Can Hit Hard

When selling property in Mexico, according to OECD tax analysis, the capital gains tax can be up to 25% of the total sale price or 30% of the net gain, whichever is higher. And because taxes are calculated in pesos, even if the property value didn't rise in U.S. dollars, currency fluctuations alone can trigger a tax liability.

6. You May Need an RFC (Mexican Tax ID)

To claim certain deductions, file property-related paperwork, or qualify for exemptions, you may need a Registro Federal de Contribuyentes (RFC), a Mexican taxpayer ID. Foreigners and dual citizens often overlook this requirement. This can stall transactions or lead to missed tax benefits.

What Happens If You Don't Pay?

Enforcement Takes Time, but It's Serious

If you've been assuming no news is good news when it comes to your Mexican property taxes, think again.

Simply because the municipality doesn't send you a reminder doesn't mean you're off the hook.

In fact, non-payment of Predial can quietly create a financial mess that surfaces at the worst possible time.

1. No Notification ≠ No Penalty

Most Mexican municipalities do not send tax bills, reminders, or warnings. There's no automatic alert system. Many foreign owners assume that if they didn't hear anything, they don't owe anything.

But in reality, unpaid Predial accrues:

- Monthly interest charges

- Late penalties

- Legal fees in some cases

The total can quickly exceed the original tax owed, especially over multiple years.

2. You'll Need Proof of Payment for Major Transactions

Even if no one's come after you yet, you will run into problems when you try to:

Sell the property. Buyers and notarios require a stamped receipt showing taxes are current. No receipt, no sale.

Get renovation permits. Many local governments won't issue permits unless Predial is up to date.

Transfer ownership through inheritance. Heirs may be denied their rights if the property is tied up with unpaid taxes.

In other words, Predial extends beyond a tax; it's a prerequisite for unlocking the full use, value, and legal protections of your property.

3. Sales Can Be Delayed or Canceled

If you're under contract to sell and your Predial remains unsettled, the notario won't proceed. We've seen closings delayed for months. In some cases, buyers walk away entirely due to tax surprises.

We help clients get ahead of these issues by verifying tax accounts, updating cadastral records, and providing direct legal assistance with property compliance.

Because in Mexico, a small unpaid fee can quietly turn into a big legal roadblock, and we're here to make sure that doesn't happen to you.

How to Legally Reduce Your Property Tax in Mexico

Strategies That Work

Even though Mexican property taxes are already lower than in most U.S. states, according to Tax Foundation rankings, there are still legitimate ways to reduce what you owe, now and in the future. Whether you're buying a new home, inheriting land, or preparing to sell, here are five proven methods to keep additional money in your pocket.

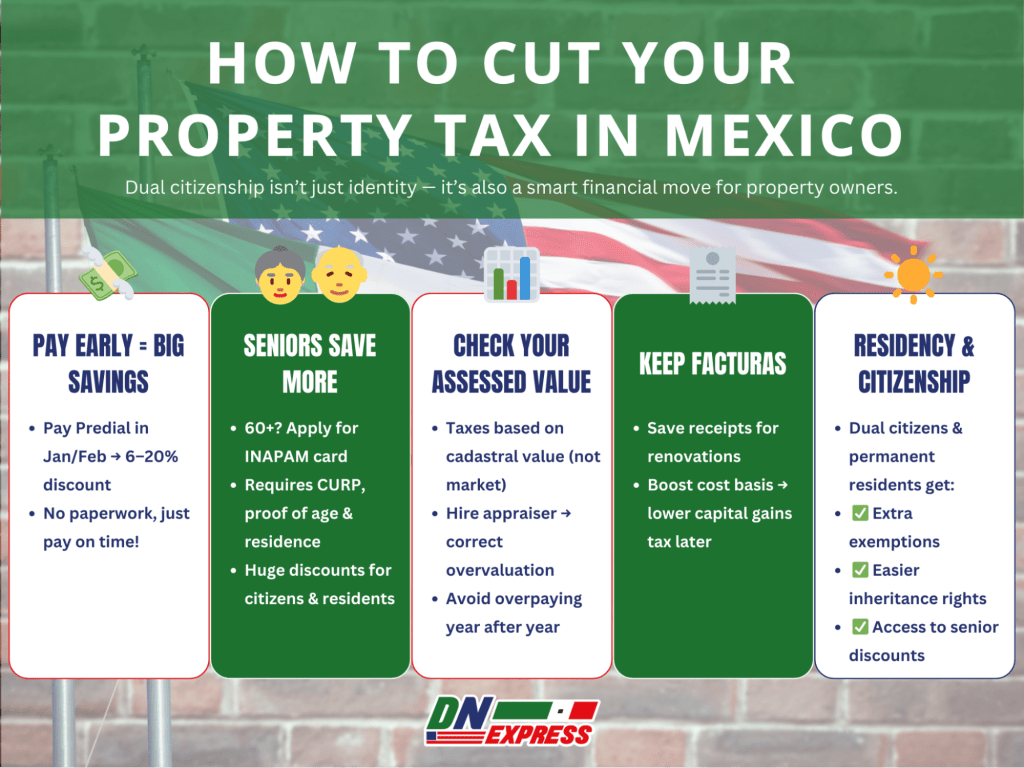

1. Pay Early to Unlock Up to 20% Off

Most municipalities in Mexico offer early payment discounts on Predial when paid in January or February. These discounts range from 6% to 20%, depending on the city or state.

It's one of the easiest ways to reduce your tax bill. No paperwork or eligibility requirements; pay early, and you save.

2. Register for the INAPAM Discount (If You're 60+)

If you're over 60, you may qualify for a senior citizen discount through Mexico's INAPAM program. With a valid INAPAM card, many municipalities will reduce your Predial significantly.

To qualify, you'll typically need:

- A CURP (Mexican ID code)

- Proof of age

- Proof of residence

This is especially valuable for U.S.-born citizens of Mexican descent who reclaim their nationality and start receiving local benefits.

3. Make Sure Your Assessed Value Is Fair

Because Predial is based on cadastral value, not market price, ensuring your assessed value is accurate remains vital. If your property has been overvalued, you can:

- Hire a certified local appraiser (perito valuador) to review it

- File a correction with the municipality

- Prevent paying inflated property taxes every year

This is one of the few areas where contesting a value can lead to long-term savings.

4. Use Facturas to Lower Capital Gains Later

Planning to renovate or upgrade your home? Make sure you get facturas (official, tax-deductible receipts) for all expenses. These documents allow you to:

- Increase your cost basis

- Reduce your capital gains tax when selling

- Stay in full compliance with Mexican tax law

Without facturas, your renovations don't count, and your capital gains bill may be unnecessarily high.

5. Get Permanent Residency or Dual Citizenship

Citizenship matters. Mexican citizens and sometimes permanent residents enjoy access to numerous benefits:

- Local-only tax exemptions

- Simplified inheritance rights

- Easier access to INAPAM and other local programs

If you're eligible for dual nationality, Doble Nacionalidad Express can help you get it without the hassle of dealing with the consulate. It extends beyond identity; it's about long-term tax and legal benefits.

Can You Own Property Without a Fideicomiso?

Yes, If You Have Mexican Citizenship

If you're a U.S. citizen looking to buy property in Mexico's coastal or border areas, you've probably heard about the fideicomiso, a bank-managed trust that allows foreigners to “own” land in restricted zones. But here's the key detail most people miss:

You don't need a fideicomiso if you're a Mexican citizen, even if you were born in the U.S.

Non-Citizens Must Use a Fideicomiso

Under Article 27 of the Mexican Constitution, foreigners cannot directly own land within 50 kilometers of the coast or 100 kilometers of the border. To legally purchase in those areas, according to U.S. State Department investment guidelines, you must use a fideicomiso, a bank trust that holds title on your behalf.

- Requires annual fees ($500-$1,000+)

- Limited control in some legal scenarios

- Must be renewed every 50 years

- Adds complexity to title transfers and sales

Dual Citizens Can Own Outright

If you're eligible for Mexican citizenship, even if you were born in the U.S., you can bypass the fideicomiso completely and own property directly under your name. That comes with some major advantages:

Fewer legal barriers. You won't need trust approvals, renewals, or foreign ownership filings.

Lower closing costs. No trust setup fees or bank management charges.

Direct title and tax registration. You'll deal with your municipality directly, which simplifies property taxes, permits, and inheritance transfers.

DNExpress Can Help You Get There

We specialize in helping people like you:

- U.S.-born children of Mexican parents

- Adults previously denied by the consulate

- Parents applying for their children

We help you secure your dual citizenship remotely, so you can own land the same way any Mexican national would, with full rights, fewer costs, and long-term peace of mind.

If your dream is to own a home near the beach or pass land down to your family, this is the smarter, simpler path. Let us help you take it.

Concerns People Have but Don't Always Ask Out Loud

“What if I never received a tax bill?”

It doesn't matter; you're still liable. Mexico does not send reminders, and unpaid taxes accrue interest and fines. You'll likely discover the debt when trying to sell or transfer the property.

“Can they auction off my home for non-payment?”

Yes, legally, municipalities can initiate an auction if your taxes go unpaid long enough, though it's rare and usually preceded by enforcement warnings.

“Do I need to pay taxes if the deed revolves around my name yet?”

Yes. Even if the title transfer is pending, if you're occupying or benefiting from the property, you may still be responsible for tax payments, especially if the Cuenta Catastral is in your name.

“Why did my tax double this year?”

Several factors could be at play. Your local municipality may have updated the cadastral value, or your property was reassessed due to improvements or political shifts. Yes, election years often see rate hikes.

“Will I get fined at the airport for unpaid taxes?”

No, but you may be blocked from selling, inheriting, or registering the property until your debts are cleared. And in some cases, the local government may deny services or permits until taxes are paid in full.

For additional questions about the citizenship process, visit our comprehensive FAQ section or explore our pricing options. If you need certified document translations or help with passport renewals, we offer complete support for all your cross-border needs.

Why Work With Doble Nacionalidad Express (DNExpress)?

Don't Try to DIY This. Here's Why

Mexico's property and citizenship systems extend beyond being different from the U.S.; they're frustratingly inconsistent.

Every municipality, registry, and tax office seems to have its own rules. If you've ever tried to deal with the Mexican consulate or file something across borders, you already know:

A single error in a name, birthplace, or document can delay your citizenship or derail your entire property transaction.

We see it every day:

- Clients who got rejected by the consulate for something as small as a typo

- People who paid thousands in extra taxes because they didn't know their rights

- Families who missed inheritance deadlines due to incomplete paperwork

Here's What Happens When You Hire DNExpress

We built our service for Mexican-Americans living in the U.S. who want clarity, legal security, and results without spending months chasing documents.

With DNExpress, you get:

- Remote processing. Skip the consulate entirely. We handle everything from the U.S.

- Licensed Mexican attorneys. Your case is managed by professionals who work directly with civil registries and property offices in Mexico.

- Speed and accuracy. We help you reclaim your nationality fast, opening the door to estate ownership, inheritance, and tax advantages.

- Problem-solving experience. Rejected by the consulate? Missing documents? Complex case? We take on what others won't.

- Where others say “it's too late,” or “it's too hard,” we say: Let's go.

If you're even thinking about buying, inheriting, or renting property in Mexico, your first move should be securing your citizenship. It's the foundation that simplifies everything that comes after, from taxes to title transfers to family legacy.

And the easiest way to do that? Start with DNExpress. We'll guide you every step of the way.

Next Steps: Reclaim Your Citizenship and Save on Taxes

If you've made it this far, you already know: owning property in Mexico comes with financial responsibilities and opportunities for savings.

But the biggest advantage? It starts with reclaiming your Mexican nationality.

Ready to make your life easier? Here's what you unlock when you work with Doble Nacionalidad Express:

- Get your dual citizenship, even if you were born in the U.S.

- Avoid unnecessary taxes, no additional fideicomisos, no surprise fees

- Secure your family's inheritance, the legal way

- Own property with full legal rights, no middlemen

- Do it all remotely, no consulate, no confusion, no wasted time

📲Schedule a Free Case Review. We'll tell you exactly what you qualify for and how we can help.

📞 Call or Message Us on WhatsApp. We're bilingual, binational, and ready to make your goals a reality.

Your property and your identity should work for you, not against you. Let's make that happen.

Questions from People Like You

Whether you're a first-time buyer, inheriting property from family, or managing a rental from the U.S., it's natural to have a few burning questions about Mexican property taxes. Here are some of the most frequent and honest questions we hear from clients every week.

Do homeowners pay property taxes in Mexico?

Yes. Every property owner is required to pay Impuesto Predial annually, regardless of whether they live in Mexico or abroad.

Do I have to pay taxes in Mexico if I live in the USA?

Yes. If you own or rent out property in Mexico, you're responsible for property taxes, and potentially income and capital gains taxes, even if you're not a resident.

Can you own property in Mexico and still live in the USA?

Absolutely. Many of our clients live full-time in the U.S. and own vacation homes, rentals, or inherited properties in Mexico. Your citizenship or residence doesn't limit your right to own.

What taxes do I pay?

Here are the main ones:

- Predial: Annual property tax

- ISAI: One-time property acquisition tax (2-5%)

- Capital gains: Due when selling, unless exempt

- Rental income tax: 25% flat on gross rental income for non-residents

How much are annual property taxes in Mexico?

Most homes pay between $100 and $500 USD annually, though luxury properties, coastal homes, or multiple properties may cost significantly higher. It varies by municipality and assessed value.

Is social security taxed in Mexico?

Mexican social security is taxable. However, U.S. Social Security benefits are generally not taxed by the Mexican government.

Who pays closing costs in Mexico?

The buyer typically covers most closing costs, including notary fees, registration, and the ISAI tax. These costs can total 5-10% of the property's assessed or declared value.