Yes, Americans can legally buy property in Mexico, even beachfront, with some restrictions.

Whether you're buying for retirement, investment, or family roots, it's completely possible with the right structure in place.

The process differs depending on whether you're a foreign buyer using a fideicomiso (bank trust), a resident, or someone with Mexican dual citizenship. From low property taxes to potential capital gains, this guide covers what you need to know before making your move south of the border, including legal risks, how to avoid scams, and how to simplify the process through citizenship.

If you're eligible for Mexican citizenship through your parents or heritage, owning property becomes far easier: no fideicomiso, lower fees, and direct title rights.

That's why many of our clients secure their nationality first before buying property.

This approach provides more than convenience, it offers peace of mind, inheritance planning, and long-term legal protection.

If you're ready to see how property ownership works for U.S. citizens, including the options for Mexican-Americans, retirees, or families, let's break it down step by step.

How Property Ownership Works for Americans in Mexico

So, how exactly does it work when a U.S. citizen wants to buy property in Mexico?

The answer depends largely on where the property is located and how you're legally set up to buy it: as a foreigner, as a resident, or as a dual national.

Restricted vs. Unrestricted Zones

Mexico's constitution protects its borders and coastlines through a rule called the “Restricted Zone.”

Foreigners cannot hold direct title to land:

- Within 50 kilometers (31 miles) of the coast

- Or 100 kilometers (62 miles) from any national border

But that doesn't mean you can't own there. You have to use a fideicomiso, or bank trust, to do it legally.

Outside of those zones? You're in the clear.

You can buy property with a direct deed (escritura pública): no trust, no special structure, no limitations.

What's a Fideicomiso?

Think of a fideicomiso as a legal workaround that gives you full control without violating Mexico's constitutional limits on foreign ownership.

- It's a 50-year renewable bank trust

- You, the buyer, are the sole beneficiary

- You have the legal right to sell, lease, remodel, or will the property like any Mexican citizen

The bank simply holds the title on your behalf.

It can't do anything with the property unless you instruct it to.

Cost Breakdown:

- Setup Fee: $500–$1,000 USD

- Annual Maintenance Fee: $500–$800 USD

- Trust Renewal: Every 50 years, but fully transferable

This structure is commonly used by Americans, especially in places like Cabo, Tulum, and Puerto Vallarta, areas that fall inside the restricted zone.

For buyers who want to avoid the fideicomiso altogether, obtaining Mexican citizenship can open the door to direct ownership in any part of the country, including beachfront lots.

Coming up next: how your citizenship status can completely change what kind of property you can buy and what kind of legal support you'll need.

Should You Build or Buy? Insights from Property Owners

Once you've decided to invest in property in Mexico, the next big question is: should you buy an existing home or build your own?

Both paths have pros and cons, and the right choice often depends on your long-term goals, budget, and tolerance for paperwork.

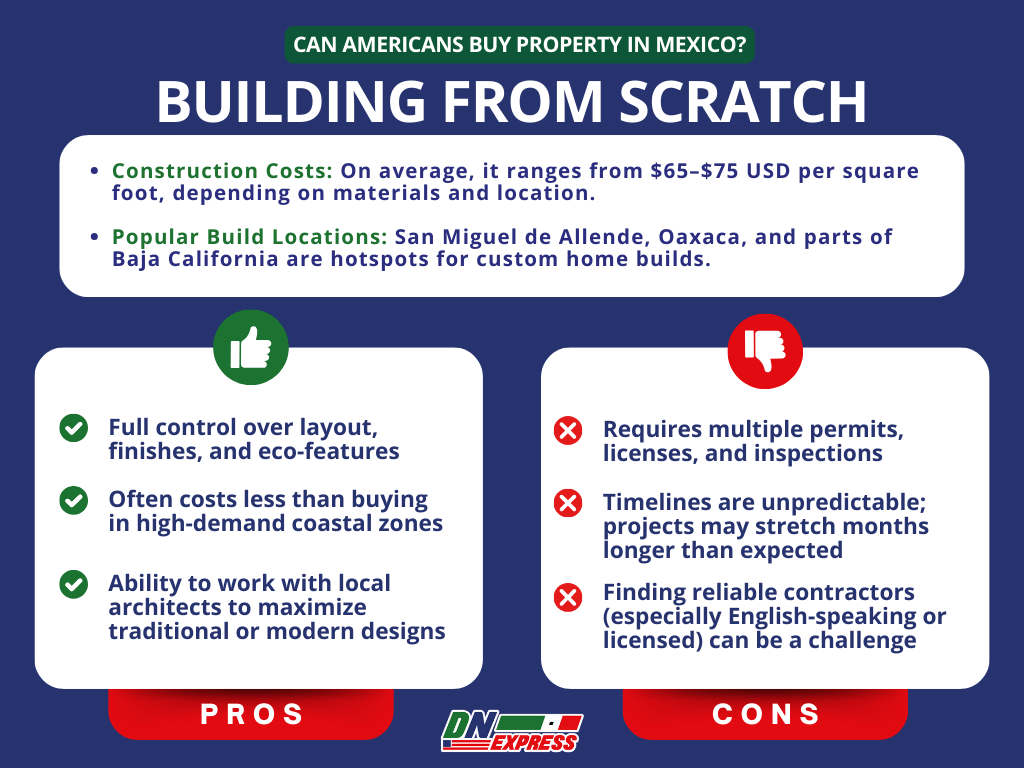

Building from Scratch

For many Americans, especially retirees or dual citizens, building a custom home is a dream that's entirely achievable in Mexico.

- Construction Costs: On average, it ranges from $65–$75 USD per square foot, depending on materials and location.

- Popular Build Locations: San Miguel de Allende, Oaxaca, and parts of Baja California are hotspots for custom home builds.

Pros:

- Full control over layout, finishes, and eco-features

- Often costs less than buying in high-demand coastal zones

- Ability to work with local architects to maximize traditional or modern designs

Cons:

- Requires multiple permits, licenses, and inspections

- Timelines are unpredictable; projects may stretch months longer than expected

- Finding reliable contractors (especially English-speaking or licensed) can be a challenge

A Concern: “Will Building in a Rural Area Attract Unwanted Attention?”

This is a fair and frequent worry we hear, especially from Americans looking to build a larger or luxury home in remote areas.

The reality? It depends on the region.

Some states and municipalities are extremely safe and welcoming. Others may have issues with organized land disputes, unclear titles, or even informal land “authorities” trying to exert pressure on new arrivals.

That's why legal due diligence is necessary before you buy or break ground.

We help clients review land titles, check zoning plans, and connect with local legal specialists to ensure their dream home doesn't turn into a legal nightmare.

Buying an Existing Home

For others, especially those new to Mexico or planning to rent seasonally, buying a move-in ready home may be the better path.

- Less paperwork, fewer delays

- Immediate livability; no months-long wait

- Easier to evaluate the neighborhood, security, and amenities before committing

Whether you build or buy, the key is learning the legal and logistical framework before you invest.

Dual citizenship can unlock smoother processes, and legal guidance can help you avoid the most costly mistakes.

What Can Go Wrong? Risks People Don't Talk About

Mexico offers incredible opportunities for Americans looking to buy property, but like any major investment, it has its blind spots.

Here are some of the most under-discussed risks you should be aware of before signing anything.

No Title Insurance or MLS

Unlike the U.S., Mexico doesn't have a nationwide Multiple Listing Service (MLS). This means:

- Prices lack standardization; the same property may be listed at different prices depending on the agent.

- Property histories are hard to verify; you can't rely on an MLS report to confirm liens, past sales, or ownership.

Title insurance does exist, but agents don't always offer it, and many buyers don't even know to ask.

Without it, if a past owner's debt or ownership dispute surfaces, you're on the hook.

Pro Tip: DNExpress clients often start by fixing old legal documents first (like a parent's birth certificate or CURP) to protect title claims or inheritance rights down the line.

Slow Appreciation

If you're expecting fast resale profits, Mexico might not deliver.

Según el Mexican Association of Real Estate Professionals (AMPI), while Mexico continues attracting foreign investment in real estate, appreciation rates vary significantly by region.

- In many regions, home values don't appreciate as quickly as in U.S. hotspots.

- The resale market is less liquid, meaning it could take months or even years to sell, especially if the property is in a rural or foreigner-saturated zone.

This doesn't make it a bad investment. It often works best for long-term use, retirement planning, or inheritance, not quick flips.

Closing Costs & Capital Gains

Many buyers are surprised by the upfront costs of purchasing property in Mexico:

- Closing Costs: Expect to pay 5–10% of the purchase price on things like notario fees, transfer tax (ISAI), trust setup (if using a fideicomiso), and legal support.

- Capital Gains Tax: When selling, you may owe Mexican capital gains tax, unless you qualify for a principal residence exemption or can prove residency.

If you're a U.S. citizen, these gains must also be declared to the IRS, even if you paid taxes in Mexico.

Navigating both systems can get tricky, especially if you don't have dual citizenship or an RFC (Mexico's tax ID).

These are the kinds of long-term risks that become obvious during an open house, but they matter deeply for your financial health and legal peace of mind.

This is why our team often recommends resolving your nationality or document issues before committing to property, because ownership should be empowering, not risky.

Why Dual Citizenship Makes Property Ownership Easier

If you qualify for Mexican citizenship through your parents or heritage, getting your dual nationality provides a major legal and financial advantage when it comes to owning property in Mexico.

Here's why so many of our clients secure their citizenship first, before making a property move.

Avoid the Fideicomiso

As a foreigner, buying in Mexico's restricted zones (near coasts or borders) means using a fideicomiso, a costly, bank-administered trust that you never fully own.

But as a Mexican citizen, you can:

- Hold the deed in your name

- Buy beachfront land directly

- Avoid bank trust fees forever

This alone can save you tens of thousands of dollars over your lifetime and give you full, direct legal ownership without outside interference.

Easier Inheritance & Taxes

Dual citizenship simplifies what happens when you pass your property on to children or family.

- You can include your Mexican property in a will that's recognized by Mexican courts.

- You avoid inheritance complications related to foreign ownership laws.

- You may be eligible for residency-based tax exemptions on capital gains or transfers.

If you're planning to build generational wealth, direct ownership through dual nationality is the safest and most efficient route.

For a complete understanding of how this affects your tax obligations, review our detailed guide on whether dual citizens pay taxes.

Stronger Legal Rights

As a Mexican national:

- You're no longer treated as a foreign investor

- Your property rights are fully protected under domestic law

- If any disputes arise (zoning, neighbors, permits), you'll have full standing in Mexican courts

For many families we work with, this sense of empowerment is as valuable as the financial savings.

This approach offers feeling secure in your investment, your identity, and your place in both countries.

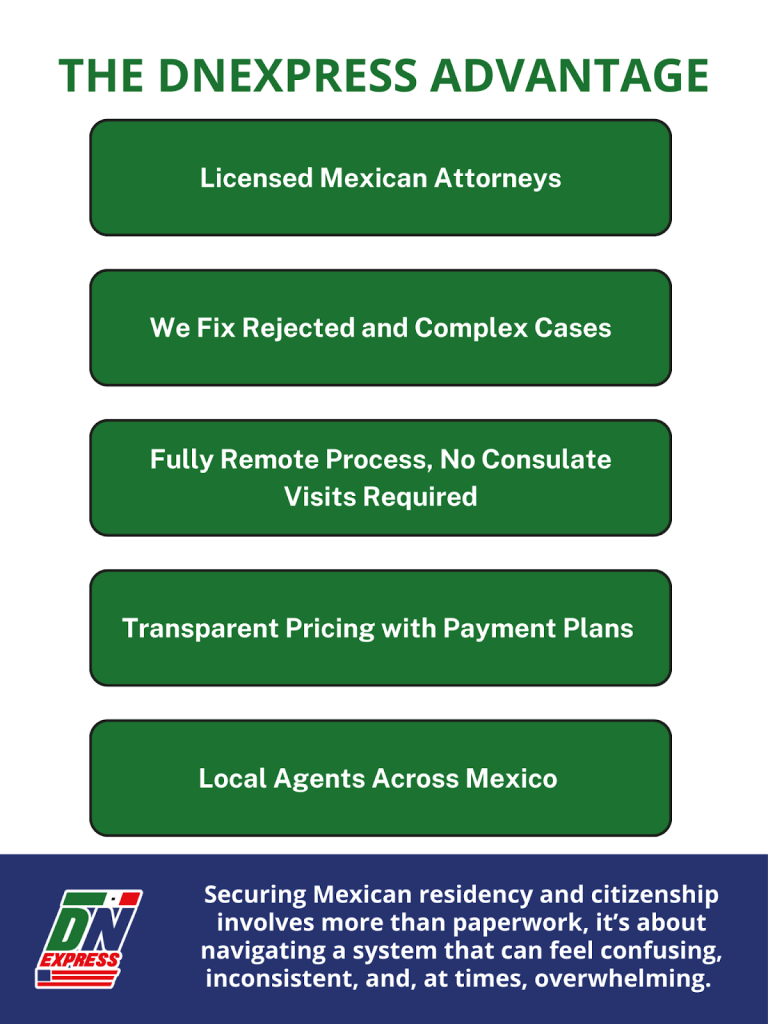

Why Work With Doble Nacionalidad Express

If you're thinking about buying property in Mexico, especially as someone with Mexican heritage, your first step should be picking a realtor.

It's getting the legal status and protections that make ownership easier, safer, and financially sound. That's where we come in.

We're a binational legal service built specifically for U.S.-born individuals of Mexican descent who want to reclaim their Mexican identity, fix critical documents, and unlock legal rights, including property ownership.

Legal Help That Goes Beyond Paperwork

We don't hand you a checklist and wish you luck.

Our team includes licensed Mexican attorneys who:

- Fix birth certificates, CURPs, and apostille issues

- Handle RFC tax ID registration (even for non-residents)

- Secure full Mexican citizenship remotely, with no consulate appointments

Whether you've been rejected before or were told you “don't qualify,” we've helped thousands of clients who thought the door was closed.

Full Support in English + Spanish

We know how frustrating the Mexican legal system can be: the delays, the inconsistencies, the language barrier.

That's why we offer:

- Bilingual communication at every step

- Remote processing; no travel required

- Zero need to visit the Mexican consulate or government offices

You'll never be left wondering what comes next or whether you filled something out wrong.

We walk you through every legal step, start to finish.

Safer, Faster, and Affordable

Our process is designed for people with goals, not red tape.

- Flat fees with no surprise charges

- Flexible payment plans to make it accessible

- Full refund guarantee if you're not eligible

We've served over 3,000 clients, many who came to us after being denied elsewhere, and helped them get approved, documented, and legally recognized in both countries.

If you're serious about buying in Mexico, let's start where it matters: your legal foundation.

Once that's in place, everything else (ownership, taxes, inheritance) becomes simpler, safer, and fully under your control.

Downsides of DIY Property or Citizenship

If you're thinking, “I'll handle this myself,” this thought crosses many minds, especially from folks who are comfortable doing their own research.

But here's the hard truth: Mexican legal systems don't work like U.S. ones, and a DIY approach can cost you far beyond what you save.

Risk of Legal Errors or Rejections

Mexico is extremely strict about documentation.

One misspelled name, a missing accent, or an incorrect date of birth can cause your entire application to be rejected, or worse, permanently flagged.

These same issues can derail a property transfer or block your ability to register utilities, sell, or lease.

Consulate Delays and Inconsistencies

Mexican consulates in the U.S. are notorious for being:

- Overbooked for months

- Inconsistent in what they require

- Understaffed and unable to provide case updates

Even when you do everything “right,” you might still be told to start over, or to drive across state lines to get a document certified.

One Small Mistake Can Block You for Years

We've helped clients who waited 5–10 years because of a minor birth certificate error.

Others were denied property ownership rights because their name didn't match their parent's Mexican records.

Once a document is rejected or flagged, it's twice as hard to fix and can delay your plans indefinitely.

No One to Defend You If Things Go Wrong

When you DIY, there's no legal recourse if something fails.

There's no lawyer to call, no advocate to step in, no one to appeal on your behalf.

And by the time you seek help, you've often lost time, money, and credibility.

This information aims to protect you.

We believe the process should be empowering, not punishing. That's why we do it all, legally, remotely, and with full legal oversight, so you can move forward with confidence, not guesswork.

Ready to Own Property in Mexico the Smart Way?

If you're a U.S. citizen with Mexican roots, or simply dreaming of a life, investment, or retirement south of the border, you don't have to figure it all out on your own.

We've helped thousands of people like you:

- Navigate the citizenship process without visiting the consulate

- Correct complicated legal documents

- Register for tax IDs (RFC)

- And finally feel secure, recognized, and legally protected in both countries

Even if you've been denied before or told you “don't qualify,” we encourage you to reach out.

Because with the right legal support, what once felt impossible becomes absolutely achievable.

Let's build your future in Mexico the smart, legal, and stress-free way.

FAQ About Buying Mexican Property as a Foreigner

When Americans consider buying property in Mexico, a lot of the same questions come up.

Let's answer them clearly, based on legal facts and years of cross-border property experience.

Can I Buy a House in Mexico if I'm a U.S. Citizen?

Yes, you can absolutely buy property in Mexico, whether you live there full time or not.

The key difference is how you buy:

- In restricted zones (near the coast or borders), you'll need a fideicomiso, a secure bank trust that gives you full rights to the property.

- In unrestricted zones, you can buy directly with a deed (escritura pública).

- If you're eligible for Mexican citizenship, you can own property outright anywhere, with no trust or foreign ownership rules to navigate.

What Are the Risks?

Mexico's property market is welcoming, but you have to protect yourself:

- Title Fraud & Ejido Land: Some land (especially rural or beachfront) is still held communally (ejido) and can't be legally sold. Others may have liens or ownership disputes.

- Unregulated Agents: Unlike the U.S., Mexico doesn't require licensing for agents. Anyone can call themselves an agent, so work only with certified AMPI members or hire a legal team.

- Permit Confusion: Zoning and building codes vary by state. Remodeling without permits can get your deed blocked.

These are exactly the kinds of issues we help DNExpress clients avoid, by getting them legal status first and reviewing every document before they buy.

Do Americans Pay Property Taxes in Mexico?

Yes, but you might be pleasantly surprised.

Property taxes (predial) in Mexico are incredibly low, typically between 0.1% to 0.3% of your property's assessed value per year.

Many homeowners pay less than $300 USD annually on full-size homes.

For comprehensive information about property taxes for dual citizens and expats, see our detailed guide on property taxes in Mexico.

Will I Owe U.S. Taxes Too?

If you rent out your Mexican property or sell it later for a gain, yes, the IRS still wants a piece.

- You'll report any rental income and capital gains on your U.S. tax return.

- But: You may be able to offset those taxes using the IRS's foreign tax credit, if you pay taxes in Mexico first.

- DNExpress clients often consult with bilingual accountants to structure everything right, especially if the property will be income-generating.

Learn more about how Mexico taxes U.S. citizens and the implications for dual nationals.

How Long Can I Stay in Mexico Without Residency?

You can stay up to 180 days on a tourist visa; no special permission needed.

But owning property doesn't automatically give you residency rights.

That said, if you want to stay longer, rent it out legally, or apply for permanent residency, owning property can strengthen your case during the immigration process.

Do I Need an RFC (Tax ID)?

If you plan to rent out, sell, or legally register utilities to your name, you'll need an RFC, Mexico's tax ID number.

Without it:

- You could be hit with 22%+ taxes on any income from the property.

- You may face issues with notaries, permits, or even selling later.

The Mexican government has made RFC registration easier for citizens abroad. According to the Ministry of Foreign Affairs, Mexicans living abroad can now register for an RFC online through the SAT virtual office from anywhere in the world.

Getting an RFC can be confusing for foreigners, especially if you don't speak Spanish fluently or want to avoid government office visits.

We help our clients register remotely, legally, and with zero consulate visits. For questions about RFC and related services, check our FAQ section for detailed guidance.